In this issue:

US REITs surged in a mixed week for global markets

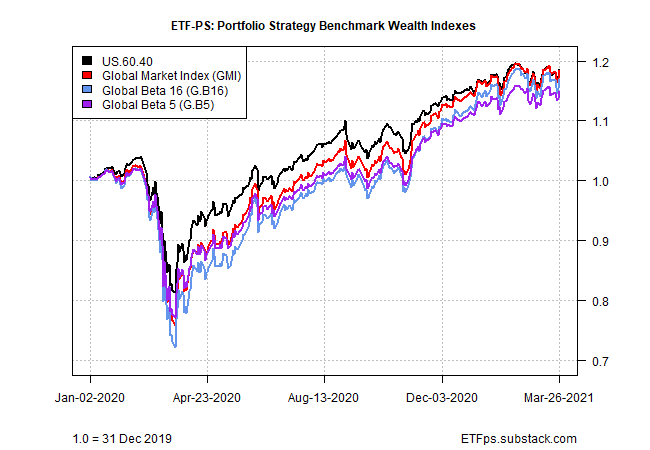

Portfolio strategy benchmarks rebounded this week

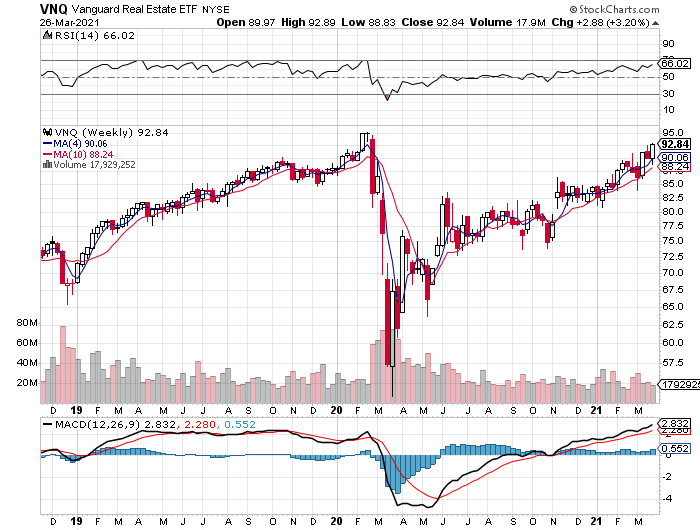

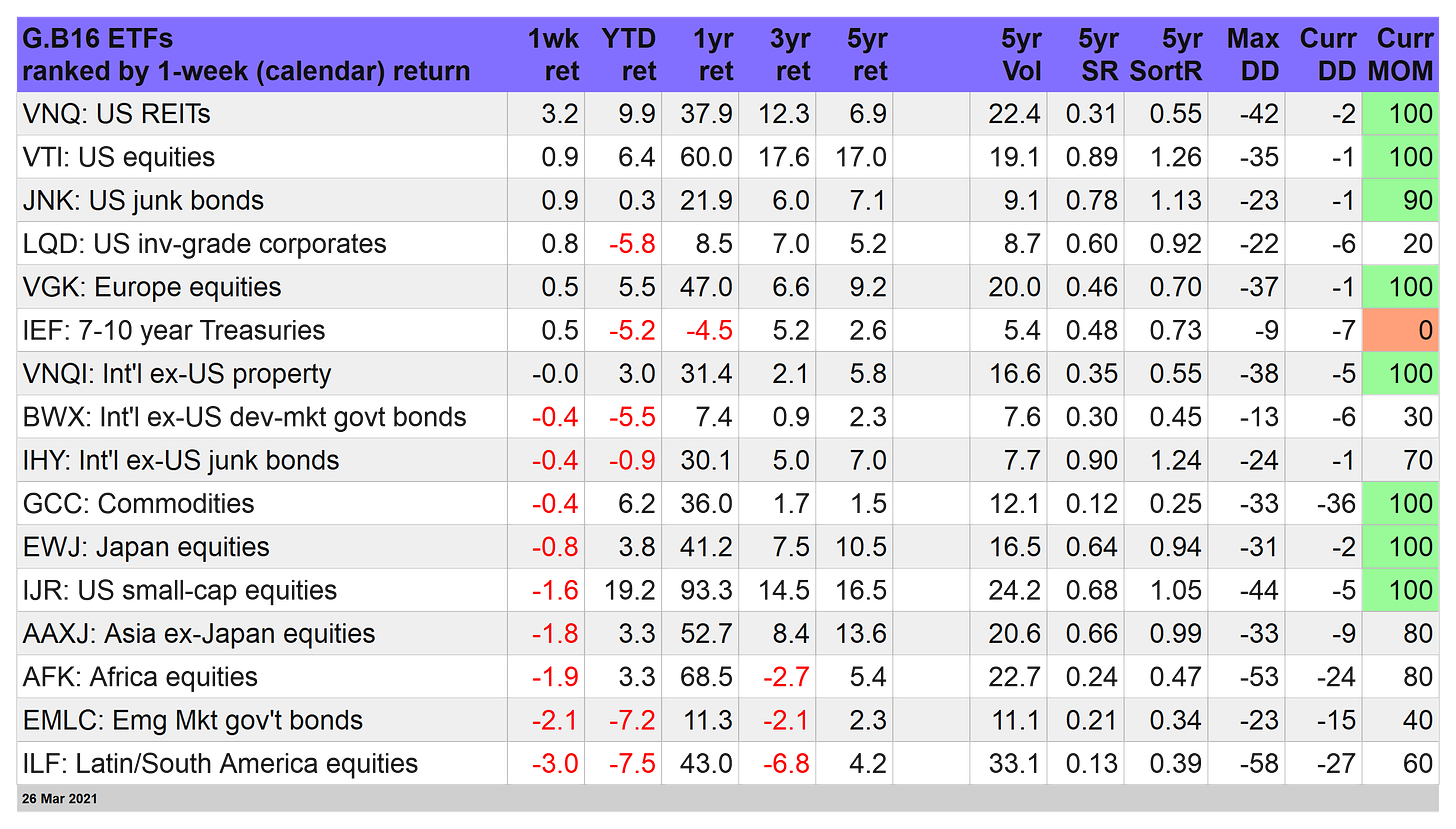

US real estate shares led global markets: The rebound in real estate investment trusts (REITs) is alive and well. Vanguard US Real Estate (VNQ) is still below its pre-pandemic peak, but this week’s 3.2% pop (through Mar. 26) puts the ETF within shouting distance of its Feb. 2020 record high.

The drop in interest rates didn’t hurt. As a yield sensitive market, REITs were losing some of their edge vs. bonds this year as Treasury rates rose. But for the first time in over two months the benchmark 10-year yield retreated on a weekly basis, settling at 1.67%. One weekly decline could be noise, of course, so all eyes will stay focused on the bond market next week to see if there’s a follow-through. But for the moment, traders are wondering if the bond market rout of 2021 is over or merely on a brief hiatus.

For this week, at least, Treasuries achieved a rare feat: posting a weekly gain this year. The iShares 7-10 Year Treasury Bond (IEF) edged up 0.5%. The weekly advance barely makes a dent after seven straight weekly declines, but it’s a start. Betting that there’s more to come still looks like a long shot, based on strong downside trend. But perhaps Mr. Market has more surprises in store for the bond market.

Stocks overall had a mixed week, with US (VTI) and Europe (VGK) posting solid gains. Asia (AAXJ and EWJ), Africa and Latin America, by contrast, felt the weight of gravity. Ditto for US small caps (IJR), which continued to reverse for a second week, although the 1.6% decline still leaves this slice of US shares with a sizzling 19.2% year-to-date rally.

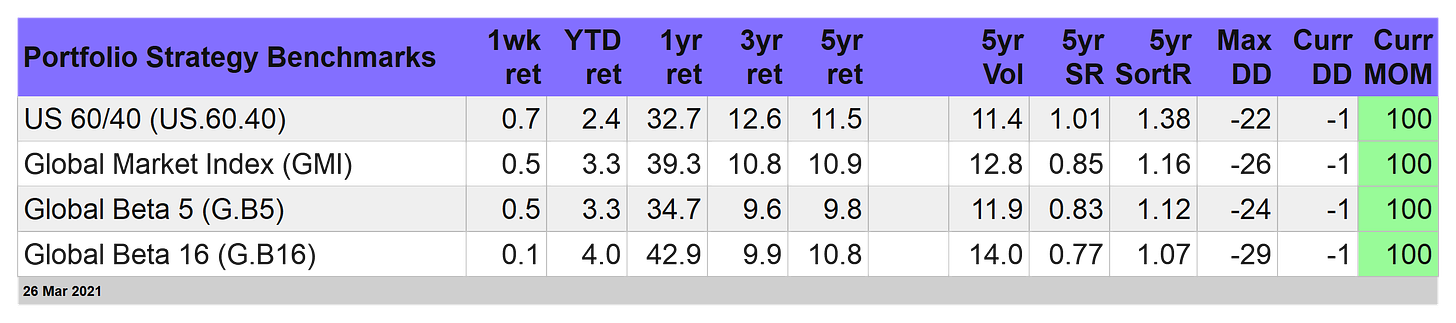

Solid gains for portfolio strategy benchmarks: Although global markets delivered mixed results this week, all four of our strategy benchmarks gained ground following the previous week’s across-the-board declines. For details on strategy design rules and risk metrics cited in this article, see this summary.

The US stocks/bonds-60/40 mix led the way with a strong 0.7% weekly increase. For the first time since January, both sides of this asset allocation were in positive terrain.

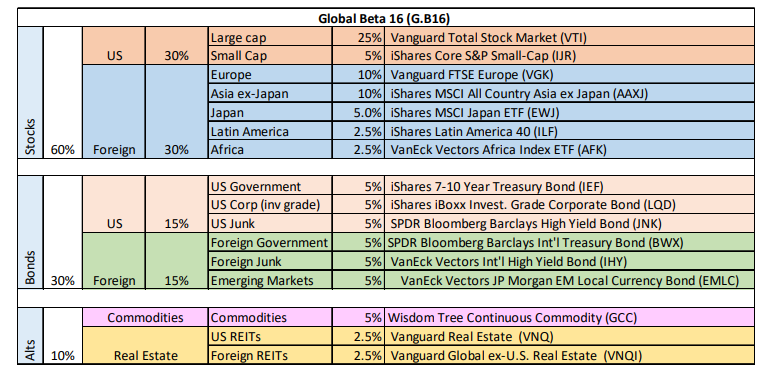

Our standard 16-fund opportunity set that powers the Global Beta 16 index (G.B16) clawed back a small portion of the previous week’s loss. The 0.1% increase was a weak rebound, but on a year-to-date basis G.B16 is holding on to a modest lead over the other three benchmarks.

Despite the positive trends this year, the portfolio benchmarks have been stuck in a range over the past month or so. Nothing goes up in a straight line, of course, and so this could be a run of healthy consolidation. Unless it’s not and the long-running up trend is running out of steam.

A key question for the weeks ahead: Will interest rates continue to rise? Or is this week’s pullback in rates a sign that the reflation trade is over? The answer will have a non-trivial influence on our strategy benchmarks and whether they’re set to break above their recent highs in the near future or continue to churn in a range. ■