The ETF Portfolio Strategist: 27 APR 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Markets continued to rebound last week, largely because of what didn’t happen. There were no major announcements on tariffs and President Trump didn’t follow through on his attacks on Powell, advising at one point that he had no plans to fire the central bank chief. US Treasury Secretary Bessent helped buoy sentiment by observing that the trade war with China was “unsustainable.” By the standards of previous weeks, the news flow was relatively quiet. If you read between the lines, took a handful of optimism pills, and squinted, you could almost see light at the end of the tunnel.

There was also some good news for the US economy, which appears to be holding on to a moderate growth rate through mid-April despite a barrage of warnings from economists that tariffs pose a serious headwind.

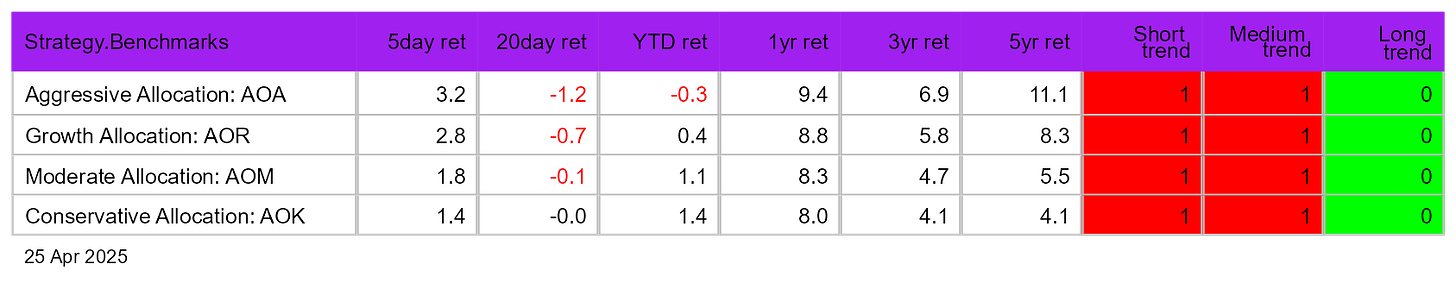

The relative calm could be a lull before the next phase of the storm, but for now the barricades of optimism are holding, providing fuel for rallies. All four of our usual set of global asset allocation funds popped last week, posting strong gains led by the aggressive strategy (AOA) with a 3.2% increase. It’s also notable that while the short- and medium-term trend indicators for the funds remain negative, the long-term signal is still positive. That suggests there’s still a possibility that the recent selloff may have run its course, in which case it will go down in history as an unusually deep but relatively short-lived correction rather than the start of a long, grinding downturn.

But let’s not get ahead of ourselves. Even if the downside bias is fading (or merely in remission?), a trading range seems the more likely outcome for the near term rather than a resumption of a bull market. All bets are off for this scenario, however, if the long-term trend signaling in the table above turns red, which remains a distinct possibility.

Meantime, the extreme volatility of late has left the market with a hefty dose of whiplash. The dramatic March-April crash in risk assets has, so far, given way to a sharp rebound, based on the Global Trend Indicator (GTI), which aggregates the technical profiles of the four ETFs above.

GTI’s drawdown has returned to a “normal” range, but the current calm is dicey proposition because the potential for more tariff-related upheaval in the days and weeks ahead remains a real and present danger.

Drilling down into the primary components of the global market shows that last week’s rebound was broad-based, led by a sizzling 6.2% advance in Latin America equities (ILF), which are up 19.1% this year, the top performer in the table below.

US equities (VTI) posted the second-best increase last week, paring the year-to-date loss to a 6.3% decline.

Tariffs are still the elephant in the room, but there are hints that a pushback is building. New lawsuits targeting the tariffs have been filed in recent days and, in theory, could soften or even reverse some of the more extreme efforts by the White House to raise the cost of imports. One line of legal reasoning: “The president doesn’t have authority outside of authorities delegated to him by Congress to issue tariffs,” said Jeffrey Schwab, a senior counsel at the Liberty Justice Center, a nonprofit with links to an Illinois industrialist and a Republican megadonor.

The White House claims that it’s making headway on tariff negotiations, but the biggest prize — a trade deal with China — appears to be going nowhere fast after Beijing said on Thursday: “Any claims about the progress of China-US trade negotiations are groundless as trying to catch the wind and have no factual basis.” The 145% tariff rate on China imports, and the 125% tariff on US exports to China, remain in effect.

Markets, in turn, remain in a wait-and-see mode, looking for more clarity, one way or another. It’s only a slight exaggeration to claim that everything still hinges on how the trade war evolves.

It’s plausible that the worst has passed and the Trump administration is now incentivized to find off-ramps and claim victories that lead to reductions in tariffs. Even if the significance of such claims is wafer thin, markets will likely rally on the news.

Unfortunately, it’s premature to assume that trade turmoil has passed into a kinder, gentler form of madness. One reason to remain cautious stems from the view that the trade turbulence has already inflicted damage on economic activity, and the evidence is only starting to emerge.

Maybe, although the numbers are mixed on that front. From the US perspective, PMI survey data for April point to an ongoing downshift in output. The US PMI Composite Output Index (a GDP proxy) eased this month, indicating that growth slipped to a 16-month low. But the Dallas Fed’s Weekly Economic Index, a real-time measure of US economic activity, is holding near its highest level in over two years and signaling ongoing resilience.

Two key economic updates this week will help frame the outlook, for better or worse, staring with the government’s initial estimate of first-quarter GDP data (Wed., Apr. 30). Nonfarm payrolls data for April follows (Fri., May 1).

Markets are desperate for deeper context on how the trade war is affecting economic activity. Let’s see if the lull in the storm can survive another week. ■