Equal weighting has its advantages — and disadvantages. Whether you should use this model-free, perfectly unbiased approach to portfolio design is debatable. But in the realm of benchmarking, there’s a strong case to adding it to the mix.

With that in mind, starting today we’ll be monitoring an equal-weighted version of the Global Beta 5 portfolio, hereafter known as Global Beta 5 Equal Weight (G.B5.ew).

Equal weighting is dead simple, but the portfolio you apply it to deserves close attention. Imagine a portfolio with ten assets. Equal weighting is easy: put 10% in each security and periodically rebalance to that weighting scheme.

The trouble begins if the ten assets are biased. To use an extreme example: If nine of the ten assets are bonds and the tenth asset a stock, equal weighting would forever dispense a heavily weighted bond portfolio. Not exactly an unbiased portfolio.

The solution, of course, is to strategically choose a mix of assets that will satisfy the equal-weighting goal. G.B5.ew does so by equal-weighting the standard G.B5 portfolio, which is intentionally targeting the four primary asset classes (ignoring cash and equivalents) on a global basis: stocks, bonds, real estate/REITs and commodities via the following five ETFs:

Vanguard Total World Stock Market (VT)

Vanguard Total US Bond Market (BND)

Vanguard Total International Bond Market (BNDX)

WisdomTree Continuous Commodity (GCC)

iShares Global REIT (REET)

Yes, there are five funds and only four asset classes. Why the mismatch? Because there are no US-listed ETFs that cover the global fixed-income market under one ticker. The next best thing (or at least one of them) is to combine BND and BNDX to create a global bond portfolio.

With that in mind, G.B5.ew equally weights the five funds as follows: 25% each in VT, GCC and REET, with 12.5% each in BND and BNDX. Voila! An equal-weighted global portfolio that covers the primary asset classes (except cash and equivalents).

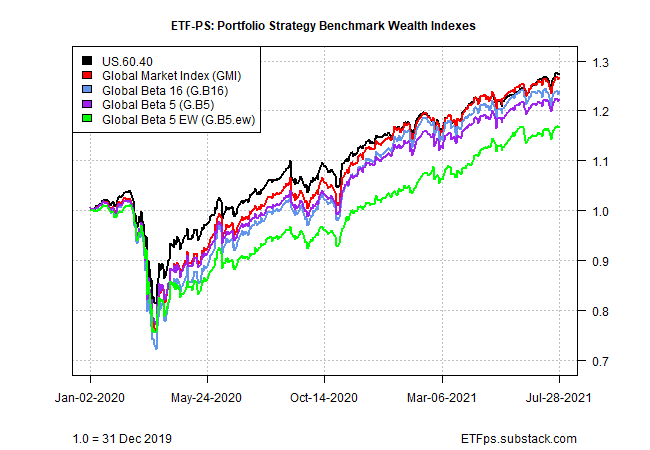

So, how has G.B5.ew performed? To be blunt, it’s been a dog in recent history, at least in relative terms against our standard benchmarks, which are weighted closer to something approximating a market-value-weighted portfolio. For details, please see this summary.

Why has equal weighted lagged? Shifting away from stocks into bonds (particularly foreign bonds in US-dollar terms) and commodities hasn’t helped in recent years. Maybe that will change in the years ahead. Wouldn’t be the first time. In fact, it’s worth noting that G.B5.ew is in first place year-to-date for the benchmarks, and by a decent margin. Hmmm.

In any case, tracking G.B5.ew in context with other benchmarks is a no-brainer. Deciding if equal weighting is a timely strategy is a topic for another day.

Meantime, the table and chart below offer a summary of how G.B5.ew stacks up against its counterparts through today’s close (July 28). ■