The ETF Portfolio Strategist: 29 Jan 2021

In this issue:

Risk-off returns to global markets

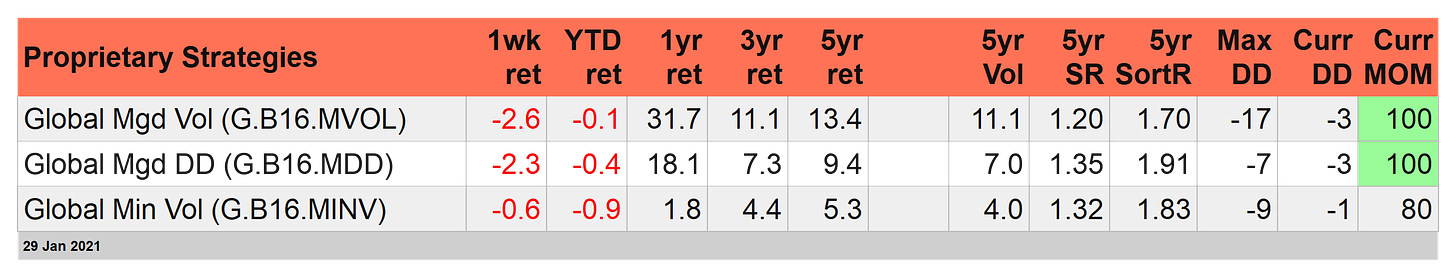

No place to hide in the strategy benchmarks this week

Managed-risk strategies suffered too

A rough way to end January: Markets around the world took it on the chin this week. Commodities and Treasuries managed to edge higher, but otherwise it was red ink across the board for our ETF proxies representing the major asset classes.

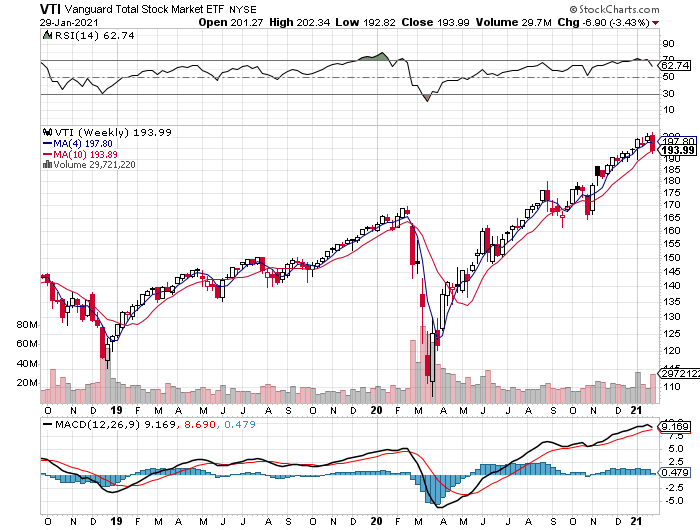

US stocks tumbled sharply, based on Vanguard Total US Stock Market (VTI). The fund dropped 3.4% for the week through today’s close (Jan. 29), the biggest weekly slide since October. VTI still appears to be in a strong uptrend, but it remains to be seen if the bullish bias is due for a deeper attitude adjustment next week.

The biggest loss this week for our global asset class proxies: equities in Africa via VanEck Vectors Africa (AFK), which tumbled almost 7% in January’s final week.

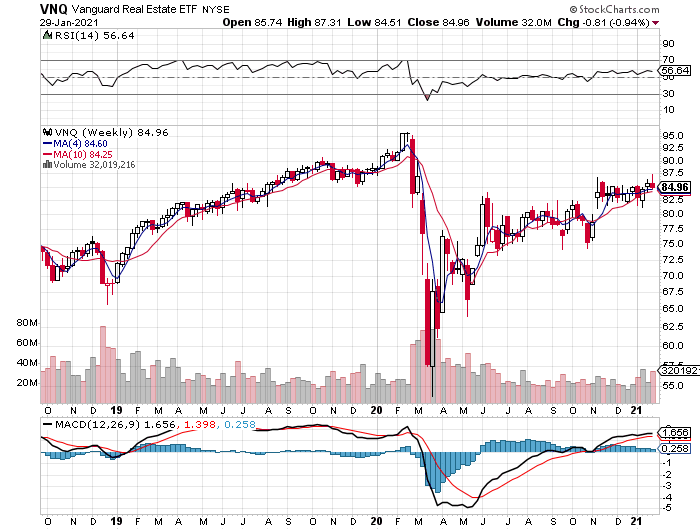

US real estate investment trusts (REITs) were among this week’s losers, but this corner has caught our eye. Vanguard Real Estate (VNQ) had been enjoying what appeared to be a breakout rally over the past several weeks after an extended run in a trading range. Earlier this week VNQ rose to its highest price since crashing last spring. It’ll be interesting to see if the fund can regain its upside momentum next week. In any case, VNQ held relatively steady this week, ending down 0.9%, which isn’t too bad considering the hefty losses elsewhere.

This week’s top performer: a broad, equally weighted mix of commodities. WisdomTree Continuous Commodity (GCC) has been a relatively calm performer with an upside bias. More of the same this week and so the ETF acted as a stabilizer for a multi-asset class portfolio, posting a 0.5% rise over the previous week’s close.

In the wake of this week’s widespread losses, 2021’s first month was a downer for most of the global markets. Except for January gains in US small caps (IJR), shares in Asia ex-Japan (AAXJ) and commodities (GCC) — along with a flat monthly return for US REITs (VNQ) — the rest of the field took a hit year to date for our list of proxies tracking the world’s major asset classes.

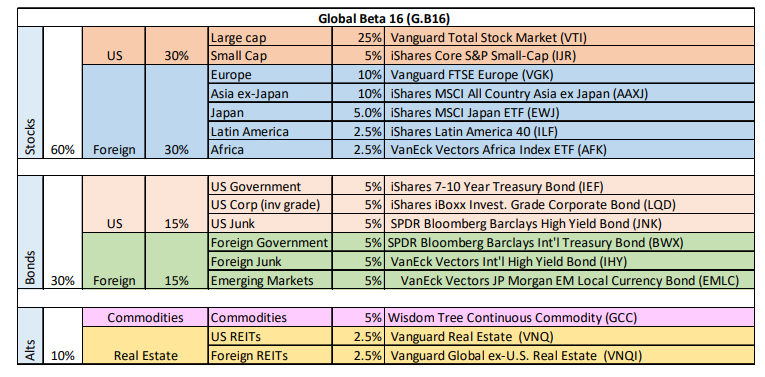

Despite the prevalence of red ink, most of the funds in the G.B16 table above continue to post bullish momentum scores (see the MOM column). Momentum works, until it doesn’t. For now, the trend still shows strong upside behavior, but next week may test that bias. (For details on all the risk metrics as well as the strategies and benchmarks, see this summary.)

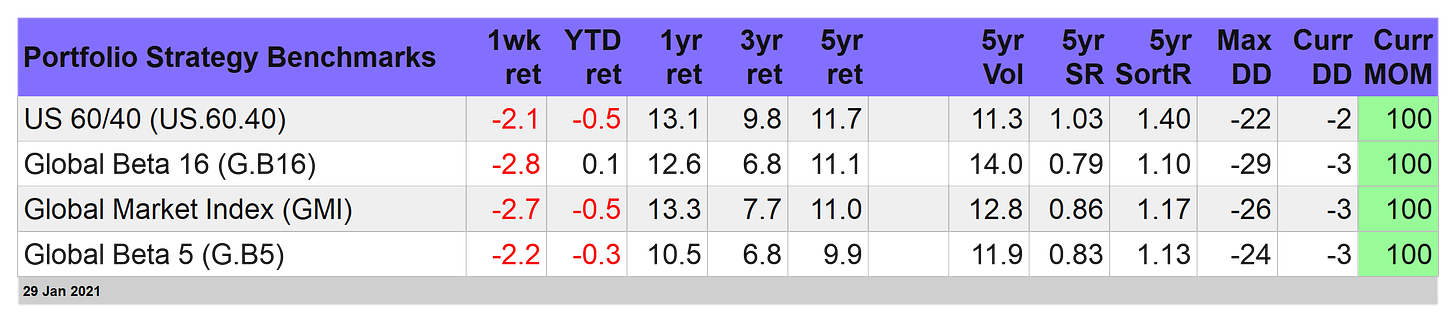

Portfolio strategy benchmarks take a beating: A deep shade of red ink weighed on our portfolio benchmarks this week. Global Beta 16 (G.B16), which holds all the funds in the table above in a targeted 60/30/10 allocation of stocks/bonds/commodities-REITs, took the heaviest blow, falling 2.8%. G.B16 is still hanging on to a slight year-to-date gain, which compares favorably against moderate losses so far in 2021 to the other three portfolio benchmarks.

Note, however, that this week’s selling has yet to affect the strategy benchmarks’ MOM scores, which remain at the highest bull-market reading. Now all eyes turn to next week for clues on whether the upside trend is set to break. For the moment, MOM suggests otherwise.

Managed risk strategies also retreated sharply: Our two most aggressive flavors of managed risk strategies fell back this week, providing minimal respite from the beta losses that prevailed. Global Managed Volatility (G.B16.MVOL) gave up 2.6%, just slightly softer than the 2.8% in its unmanaged benchmark (G.B16). Note that G.B16.MVOL targets the same set of ETFs held by G.B16, with the only exception that a risk-off/risk-on overlay is applied.

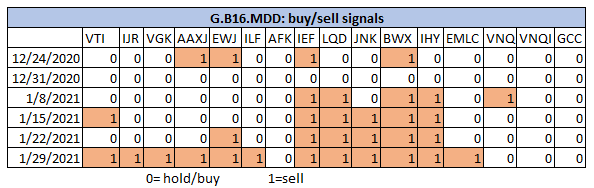

G.B16.MVOL’s brand of risk management wasn’t much help in recent days, due in no small part to the fact that the strategy remains risk-on for every holding except Asia ex-Japan (AAXJ), which flipped to risk-off at the end of today’s trading.

Global Managed Drawdown (G.B16.MDD), by comparison, has had a moderate risk-off position recently, but that didn’t offer much help either this week. The strategy fell 2.3%, albeit slightly less vs. G.B16.MVOL and its benchmark (G.B16). Meantime, G.B16.MDD is doubling down on its risk-off posture as more of its holdings flipped at today’s close. That leaves just four of 16 holdings in risk-on: equities in Africa (AFK), US REITs (VNQ), foreign property shares (VNQI) and commodities (GCC).

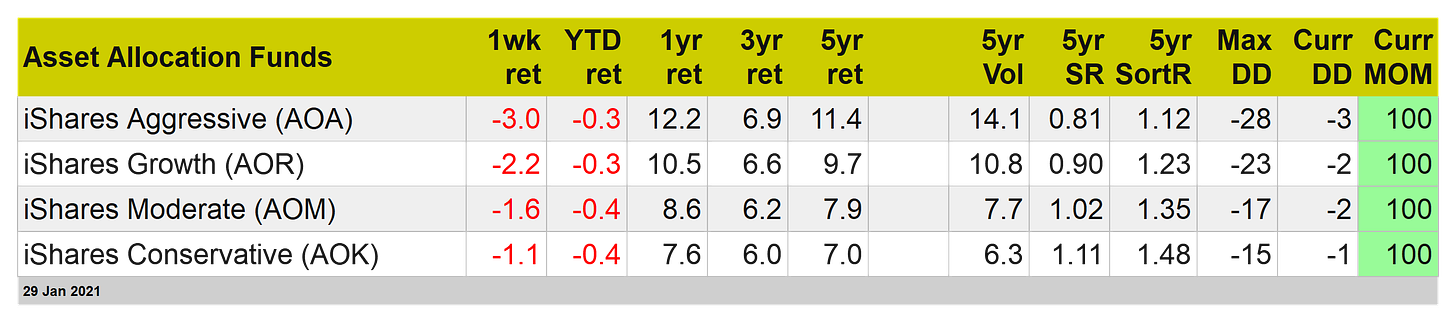

BlackRock’s four asset allocation ETFs also suffered this week, albeit with a relatively wide range of losses. The deepest decline was, appropriately, in the most aggressive strategy: a 3.0% slide in iShares Aggressive (AOA). At the opposite end of the spectrum: iShares Conservative (AOK), which fell a comparatively mild 1.1%. Note, however, that all four asset allocation funds are now in the red for the year so far, albeit modestly.

There’s a lot to unpack for the markets next week. Between monitoring the debate in Washington over the details for a new coronavirus relief package, a busy week of US economic releases (including January payrolls), and a pandemic that’s still roiling the nation and the world, there’s no shortage of issues that could go bump in the night. Add to that a new dose of market volatility on Wall Street’s radar and it’s a safe bet that the days ahead will be anything other than dull. Buckle up! ■