The reflation trade continues to lose momentum, or so the ongoing slide in the 10-year Treasury yield suggests.

When the trading session closed today (June 30), the 10-year rate dipped to 1.45%. That’s the third time this month that the benchmark rate fell to that level. If the 1.45% floor gives way, the downside break will be widely seen as a sign that rates will test even lower levels in the weeks ahead.

Part of the reasoning for shifting away from a reflation forecast is the hawkish attitude adjustment unleashed by the Federal Reserve earlier this month. At the central bank’s policy meeting on June 16, Federal Reserve Chairman Jerome Powell and company reminded the crowd that they were prepared to start tightening policy if and when economic conditions signaled that it was time for a change. As a result, the market further discounted the assumption that the Fed was willing to let inflation run hotter for longer.

Perhaps the leading clue that the market is pricing in higher odds that the Fed’s embracing a more hawkish stance, if only on the margins: the 2-year Treasury yield broke well above its trading recent in the past two weeks. Widely considered the most sensitive point on the yield curve for rate expectations, the 2-year rate senses a rate hike (and/or other policy tightening moves) is nearer than previously thought.

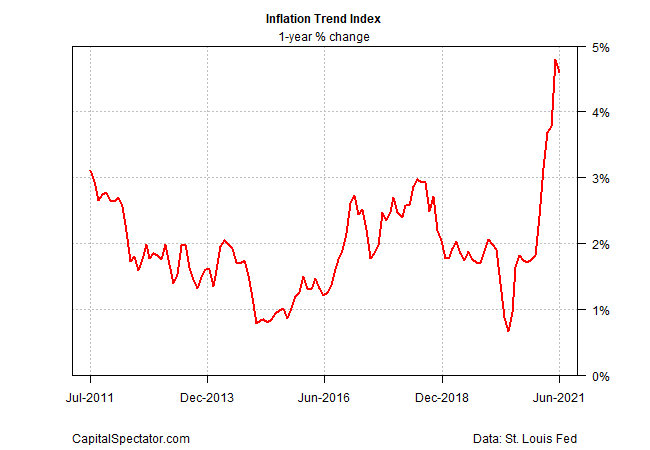

The critical numbers, of course, are the official inflation data and on that score it’ll take several months at the least to cut through the pandemic-related noise and discern a genuine trend. Meanwhile, one clue that the recent surge may be peaking: the Inflation Trend Index continues to show a decline for the June estimate relative to May.

Hotter-than-expected inflation numbers in the weeks ahead could change the calculus, but for the moment the market is becoming more comfortable with one or two narratives. That is, the Fed’s inflation-is-transitory outlook is correct. If not, the central bank will tighten policy to nip emerging inflationary pressure in the bud. Doing so early and effectively on the short end of the curve may allow longer rates to hold steady or fall, or so the current logic runs.

That logic continues to support iShares 7-10 Treasury Bond ETF (IEF), which popped today and is near a four-month high. It’s premature to assume that IEF’s rebound over the past three months will carry it to last year’s highs. Then again, arguing that rates are headed higher is getting tougher — unless the incoming inflation numbers continue to deliver upside surprises. ■