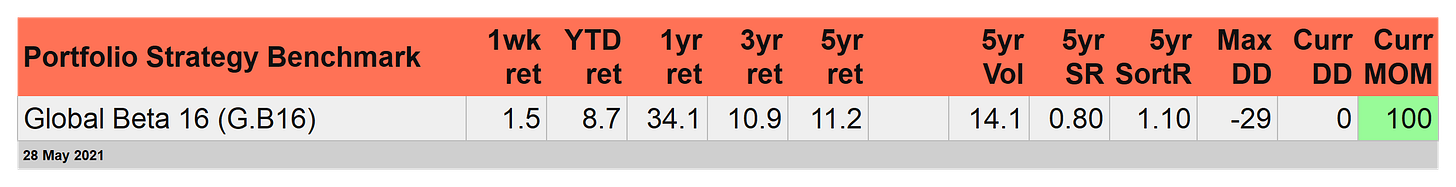

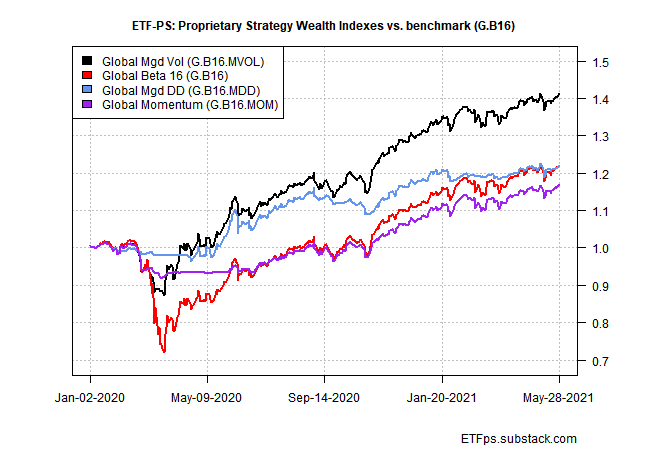

Keeping up with the benchmark remains challenging this year for our trio of proprietary strategies. Global Beta 16 (G.B16), which routinely holds all 16 funds in the targeted global opportunity set, is up 8.7% year to date. That’s modestly ahead of two of the prop portfolios and far ahead of a third. (Note that all three prop strategies and the benchmark use the same 16-fund opportunity set; the only difference is in the risk-on and risk-off signals.) For details on strategy rules and risk metrics in the tables below, please see this summary.

Over the longer-run (five years), all the proprietary strategies enjoy substantially stronger risk-adjusted results (Sortino and Sharpe ratios, for instance). But 2021 is proving to be a rough year for maintaining an edge over a simple beta mix that spans the globe and the major asset classes.

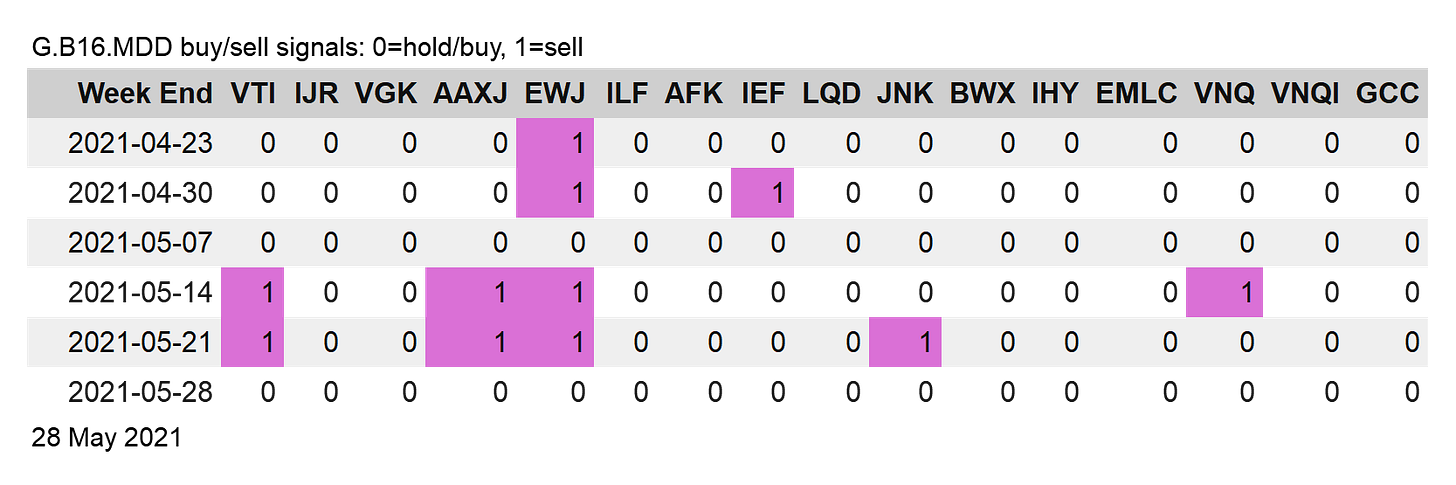

For rebalancing activity, two of the three proprietary strategies generated trading signals. Global Momentum (G.B16.MOM) reshuffled its portfolio, slightly. VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (EMLC) shifted back to risk-on after the end of trading for this month. The change leaves G.B16.MOM with 13 of the 16 funds in the opportunity set in risk-on postures — the most aggressive posture for the monthly rebalanced strategy since February.

Meantime, Global Managed Drawdown (G.B16.MDD) shifted to risk-on across the board.

There were no changes for Global Managed Volatility (G.B16.MVOL), which remains in a full-on risk-on position. ■

asdfadsf