The ETF Portfolio Strategist: 30 Oct 2020

The baby and the bathwater: Risk-off dominated global market activity this week as investors dumped every slice of our standard lineup of the major asset classes as of today’s close (Oct 30).

You didn’t have to look hard for a catalyst. Start with coronavirus. The news in the US and Europe is turning grim once more. New cases of Covid-19 in the US reached a record high on Oct. 29, raising concern that the winter could bring a new economic and health challenges. Europe’s struggle with the coronavirus is even worse and countries are imposing new restrictions in reaction to a second surge of cases that shows few sign of slowing.

As if that’s not enough to consider for investment strategy, next week brings the US election, which could be a contentious affair that leaves the outcome unclear for days or weeks. Mr. Market isn’t registered to cast a ballot, but he seems to be voting with his feet.

The deepest setback this week in our global opportunity set: Latin/South America stocks. The iShares Latin America 40 ETF (ILF) tumbled 8.0%, leaving the fund near a one-month low.

US stocks fared modestly better with a 5.6% decline for the week, based on Vanguard Total US Stock Market (VTI).

Where’s the port in the storm? The usual safe haven – bonds – offered no assistance in the latest risk-off move, at least for medium-term maturities. The iShares 7-10 Year Treasury Bond (IEF), for example, edged down 0.3% on the week — the softest slide for our global opportunity set.

IEF is now at its lowest close since June 9. Some analysts have been warning that bonds don’t offer the same safe-haven properties of years past due to ultra-low interest rates. This week’s trading results certainly don’t offer a counterpoint. Even shorter maturities were on the defensive: iShares 1-3 Year Treasury Bond (SHY) ticked down fractionally for the trading week.

In the wake of this week’s selling, only two markets continued to post high levels of upside momentum, based on our proprietary metric: Japan equities (EWJ) and stocks in Asia ex-Japan (see MOM column). The weakest momentum profile is Latin America stocks (ILF), which is currently at a MOM rank of 20, or just above the lowest score: 0. (For details on all the risk metrics as well as the strategies and benchmarks, see this summary.)

Note, too, that red ink now dominates the year-to-date return column. The main exceptions: investment-grade US bonds (IEF and LQD), Asia ex-Japan equities (AAXJ) and US equities.

Turning to our portfolio benchmarks, losses weighed on results across the board with declines ranging from -3.4% to -4.0%.

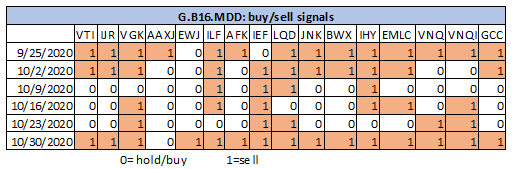

Playing defense: Our proprietary strategies weren’t spared this week although the losses were relatively light for Global Managed Drawdown (G.B16.MDD) and even more so for Global Minimum Variance (G.B16.MINV) vs. the benchmarks. (Note: all three of the in-house portfolio strategies below target the same opportunity funds set that comprises the G.B16 portfolio benchmark, per the ETF table above.)

Global Managed Volatility (G.B16.MVOL) took a bigger hit, sliding 3.9% on the week. That’s not terribly surprising since G.B16.MVOL remains in a risk-on position across the board for all 16 funds.

The more cautious Global Managed Drawdown (G.B16.MDD) is another story. After this week’s selling, G.B16.MDD is nearly all-in on risk-off. The one exception: Asia equities ex-Japan (AAXJ), the lone holding in the strategy in the wake of today’s close. If markets are set to suffer further, G.B16.MDD is poised to benefit. According to the strategy’s internal signals, more selling generally is the higher implied probability.

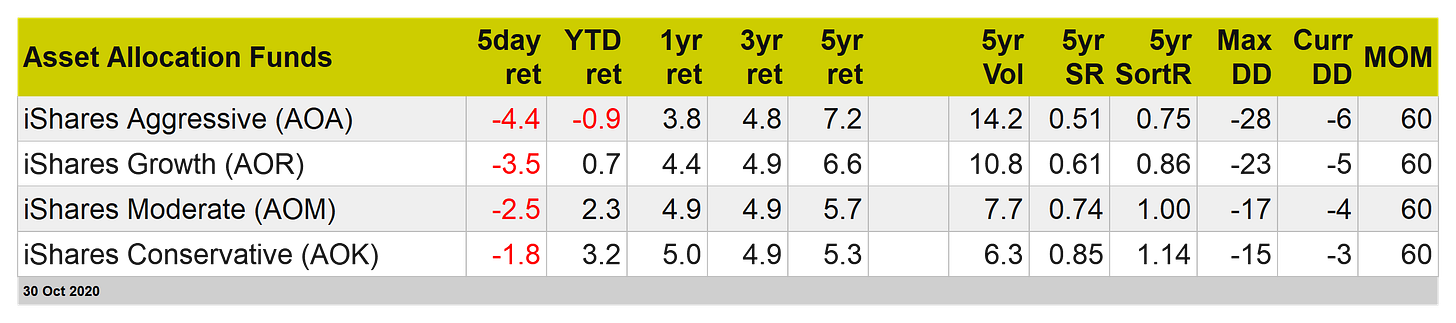

BlackRock’s ETF-based variations on four degrees of asset allocation risk ended down on the week. The deepest shade of red: a 4.4% tumble for iShares Aggressive (AOA).

Markets are left struggling to price in renewed coronavirus risk and the uncertainty of next week’s US election. The threat of a long, drawn-out election muddle may end up as much ado about nothing, but Covid-19 blowback will likely remain a challenge for the global economy for the foreseeable future. Pricing risk, in short, still looks set to be the toughest game in town until further notice. ■