The ETF Portfolio Strategist: 4 Dec 2020

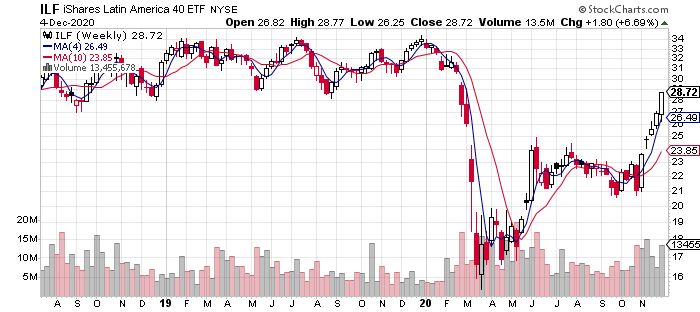

Bullish Momentum Accelerates For Latin America Equities: Stocks listed across Mexico and South America are on a tear. Although this slice of global equities remains the only major region still nursing year-to-date losses, recent history is another story as the upside run for iShares Latin America 40 (ILF) continues pick up speed.

For the third straight week, ILF topped weekly returns for our broad set of ETF proxies for global asset classes via a 6.7% gain for trading through today’s close (Dec. 4). Even more impressive, the fund has posted weekly gains for five weeks in row. Despite the recent run, ILF is still well below its pre-pandemic level, although the gap is closing fast.

After this week’s rally, ILF’s momentum score (via our proprietary MOM measure) edged up to 90, one notch below 100, the strongest rank for upside bias. (For details on all the risk metrics as well as the strategies and benchmarks, see this summary.)

That leaves only one piece of our global-minded opportunity set with a weak MOM score: iShares 7-10 Year US Treasury Bonds (IEF), which ended this week with a 20 rank -- just two notches above the 0, the lowest possible level of MOM.

Overall, widespread gains prevailed for most of the global markets… again! In recent history, nearly every corner of the major asset classes has enjoyed weekly advances.

US equities participated in the rally. Vanguard Total US Stock Market (VTI) rose 1.8% this week, lifting the fund to yet another record close.

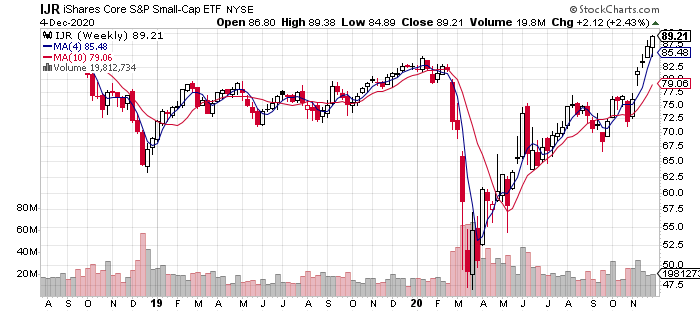

US small-cap stocks continue run hot, in relative and absolute terms. Not only did iShares US Core S&P Small-Cap Equities outperform broader measures of American shares, IJR beat everything except for Latin America (ILF) and Africa (AFK) stocks this week.

What’s driving small caps? Part of the answer may be a valuation play. As the big-cap US names become increasingly pricey, the relatively overlooked small-cap realm’s appeal is growing. According to Morningstar.com, IJR’s price-to-earnings ratio is moderately discounted against VTI (16.4 vs. 19.4). While we’re talking valuation, note that ILF and AFK’s p/e discounts vis-à-vis VTI are even bigger: 12.0 and 10.5, respectively.

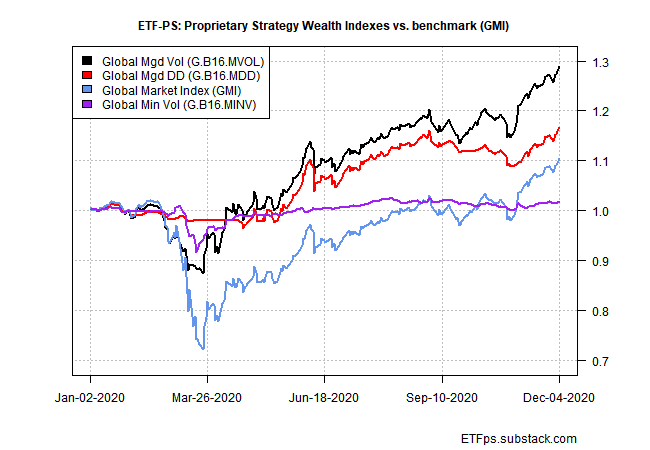

Benchmark Momentum: As widespread gains continue to pour over most of the global markets, the upside bias in our broadly defined benchmarks rolls on. Global Beta 16 (G.B16), which holds all the asset classes listed in the table above, was the top performer this week with a 1.4% increase. Impressive, but increasingly par for the course – G.B16 hasn’t had a down week since October’s close.

Our two aggressive proprietary strategies also continued to notch fresh gains. Global Managed Volatility (G.B16.MVOL) and Global Managed Drawdown (G.B16.MDD) each rose 1.4% this week. In both cases, solid benchmark-beating gains appear likely for 2020 (both strategies target the same 16-fund opportunity set as G.B16).

G.B16.MVOL continues to remain in a full risk-on position, holding all 16 funds in its opportunity set (based on G.B16’s tickers shown above). G.B16.MDD is nearly all risk-on with one exception: iShares 7-10 Year Treasury Bond (IEF) remains risk-off.

BlackRock’s four asset allocation funds (which routinely show up on these pages as another set of strategy benchmarks) had a good week, too. Returns ranged from 0.3% for the conservative mix (AOK) to 1.2% for the aggressive strategy (AOK).

How long can the bull run continue? Increasingly worrisome news on coronavirus doesn’t seem to be a threat. Ditto for today’s news that the US labor market’s growth rate continues to slow – payrolls rose by substantially less than economists expected, the Labor Dept. reports.

Optimism on the progress with vaccines seems to be overwhelming the bears. “Bullishness is rampant,” observes David Rosenberg of the eponymous Rosenberg Research & Associates. “Life has been good for risk assets this year, once governments and central banks primed the pump like never before.”

The threat is that the party’s gone too far for too long. “This is how asset bubbles are formed and we are in one now and could well be in one for years to come.” ■