The ETF Portfolio Strategist: 5 Feb 2021

In this issue:

Global markets rebound

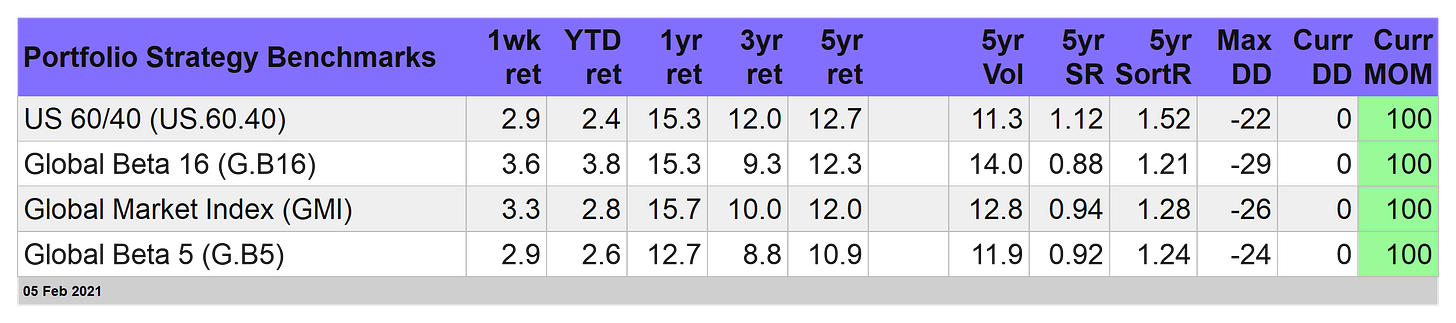

Strong week for portfolio-strategy benchmarks

Risk-on pays off for one of our managed-risk strategies

Return to form in February: The late-January correction turned out to be another head fake for risk assets, which rebounded sharply this week. Equities across the board were higher, led by a strong gain in Africa stocks, which topped our set of fund proxies that collectively represent the world’s major asset classes. (For details on all the risk metrics in the table below, along with profiles of the strategies and benchmarks discussed, see this summary.)

VanEck Vectors Africa (AFK) surged 6.5% this week through Friday’s close (Feb. 5), regaining nearly all its losses in the previous week. The fund is still below its last high, set in early-2018, but the recent upside momentum suggests that the old peak may soon give way.

Equities overall had a good week, with robust rallies countering the previous week’s red ink. US small caps rallied 5.5%, lifting the fund to a new record high, based on iShares Core S&P Small-Cap (IJR).

US shares overall rallied every day this week, based on Vanguard Total US Stock Market (VTI). The week’s gain was enough to push the ETF to a new record close.

This week’s losers for the major asset classes, based on our set of proxy funds, were limited to US and foreign developed-market bonds. The biggest setback was logged by SPDR Barclays International Treasury Bond (BWX). The fund, which tracks government bonds in developed markets ex-US, tumbled 1.0% this week – BWX’s fifth straight weekly loss.

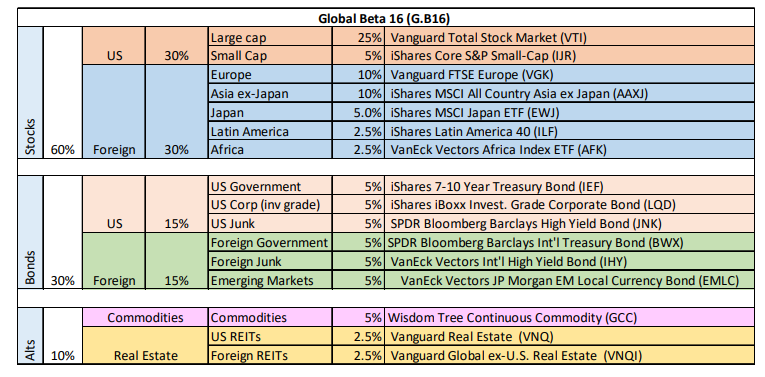

Strategy Benchmarks Bounce Back: With most markets returning to a risk-on profile this week, our strategy benchmarks revived once more. Global Beta 16 (G.B16) delivered a strong 3.6% rebound this week, pushing our main strategy benchmark that holds all the funds in the table above to a 3.8% year-to-date gain. (Note that table below is ranked by 5-year returns.)

Our proprietary MOM scores for all four strategy benchmarks continues to rank at 100, the strongest level of bullishness. Pricing behavior is still signaling that higher prices remain the path of least resistance for multi-asset-class portfolios.

Risk-on pays off for out volatility-managed-risk strategy: Last week it looked a bit dicey for Global Managed Volatility (G.B16.MVOL), but a week later it’s back to the races.

G.B16.MVOL recovered with a solid 3.2% gain this week. When the market closed today, the strategy was again all in with risk-on after reversing its lone risk-off position.

Global Managed Drawdown (G.B16.MDD), on the other hand, has lagged, thanks to recent risk-off signals for the strategy that, so far, have proved to be off the mark. As a result, G.B16.MDD’s gain this week was a relatively tepid 0.4%. Several of G.B16.MDD’s risk-off positions have moved back to risk-on today, but the strategy remains relatively defensive. It remains to be seen if the defensive bias is noise or prescient, but so far it’s been a drag on performance relative to G.B16.MVOL’s results.

BlackRock’s quartet of asset allocation ETFs had a good week. The most-aggressive fund (AOA) was up a strong 3.5%, just a hair behind our Global Beta 16 (G.B16) strategy benchmark.

The future’s unclear as always, but the week just passed suggests that markets are comfortable with the Biden administration’s embrace of a new round of coronavirus relief. Both the House and Senate approved the $1.9 trillion plan today, albeit with no Republican support. Bipartisanship in Washington still appears dead, but the markets aren’t complaining. ■