In this issue:

Mixed results for asset classes as interest rates continue to rise

Global strategy benchmarks recover… slightly

Close, but no cigar: The losers still outnumbered the winners, but at least the mix was closer this time. Nonetheless, the ongoing rise in interest rates continued to unleash pain across broad sections of the global markets – bonds in particular. For details on risk metrics in the table below, see this summary.

The biggest setback for ETF proxies for the major asset classes: US investment-grade corporates, which fgave up ground for a seventh straight week The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) tumbled 1.7% for the week through today’s close (Mar. 5). The haircut left the fund at its lowest price since last June.

Notably, the only gain in fixed-income in the table above was for US high yield. SPDR Barclays High Yield Bond ETF (JNK) eked out a 0.4% increase for the week, the first in the past three. Otherwise, the ongoing rise in rates continues to weigh near and far on fixed-income markets. The poster boy for the pain is clearly visible in the upswing in the 10-year Treasury yield, which rose for a sixth straight week to 1.56%, the highest in more than a year. Eye-balling the chart below suggests there’s more upside to come in the weeks (months?) ahead.

Despite another installment of the reflation show this week, there were winners, at least in relative terms. The outlier on the upside: equities in Latin America. The iShares Latin America 40 ETF (ILF) still looks wobbly, but the 2.8% gain was a welcome respite this week and the strongest for our global opportunity set.

US small caps posted a respectable gain, too, rising 1.9% for the week. Even better, the trend on this front still looks bullish.

US stocks overall managed to squeeze out a gain as well, based on a broad measure of shares via Vanguard Total US Stock Market (VTI). The fund closed up 0.3%, the first weekly gain in the past three.

Strategy benchmarks rebound: All three of our global strategy benchmarks rebounded, slightly, after a sharp decline in the previous week. The exception: the US 60%/40% stock/bond mix (US.60.40), which slipped 0.1% this week. For details on strategy design rules, see this summary.

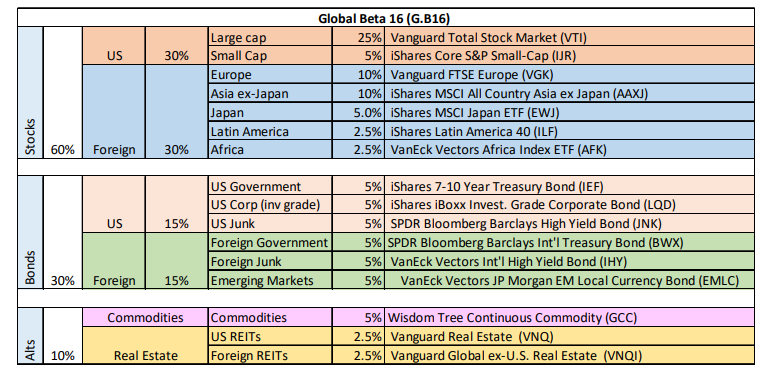

Global diversification, in other words, paid off, at least modestly. Year to date, global’s edge is even more conspicuous. Leading the way is Global Beta 16 (G.B16) with a 2.2% gain so far this year through today’s close. Although the bond slice of the portfolio is taking a beating, for the moment the rest of the asset allocation is making up the difference and then some for 2021 to date.

The year-to-date pop is encouraging for global diversification, but with interest rates rising and inflation expectations firming there’s still plenty of opportunity for trouble ahead. From a benchmark strategy perspective, however, the latest run of turbulence still looks like noise in a generally rising trend, as the wealth indexes above suggest. If there’s a change in the narrative brewing, next week may drop a clearer warning. ■