The ETF Portfolio Strategist: 5 MAY 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Global markets rebounded for a second week, strengthening the view that April’s correction has passed. It’s too early too embrace that idea fully as a strategic all-clear sign, but the broad sweep of market gains last week surely ticks the tactical odds a bit more in favor of the bulls.

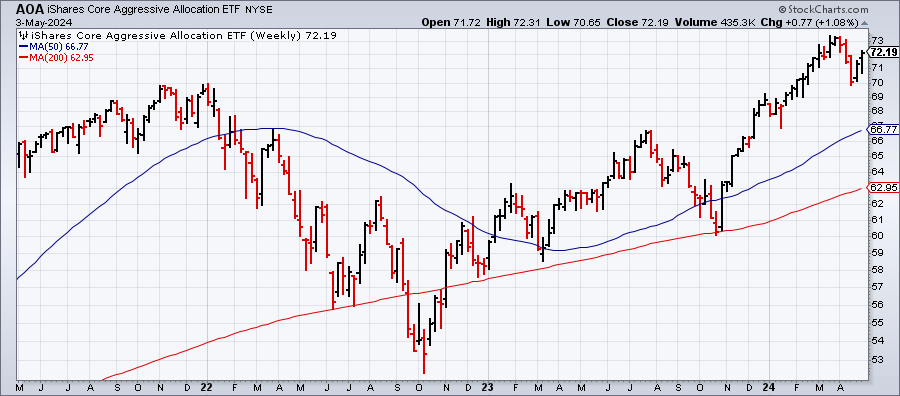

The trend certainly looks firmer from a portfolio perspective after last week’s rallies. All four flavors of asset allocation risk rose 1% in the trading week, based on the ETFs in the table below. Note, too, that the Signal scoring ticked up as well and is now at a moderately bullish 4 for all the funds. See this summary for details on the metrics in the tables below.

Taking the optimism to the next level will require prices to retake previous peaks. In the case of the aggressive asset allocation ETF (AOA), for instance, that peak is close and the fund could possibly overtake it as soon as this week.

Meanwhile, there’s a lot more green on the screen for the major slice of the global markets. US junk bonds (JNK) and European equities (VGK) are leading the chart with Signal scores of 6.

From a US perspective, the softer-than-expected payrolls report for April inspires hope that sticky inflation risk may soon begin to fade, which in turn revived hope that the Federal Reserve will be able to start cutting interest rates later this year. Fed funds futures are estimating a moderately confident probability (66%) that the central bank will trim its target rate at the Sep. 18 FOMC meeting.

Meanwhile, recession risk still appears low, based on a GDP nowcasts. The Atlanta Fed’s GDPNow model sees a rebound in second-quarter output following Q1’s slowdown.

The bond market is on board with last week’s return of cautious optimism. The US Treasury market’s 5-year breakeven inflation rate (a proxy for the crowd is expected inflation rate for the next 5 years) fell sharply last week to 2.35%, extending the recent downturn to the lowest level in nearly two months.

Stepping back, the prospect of low recession risk, fading sticky inflation risk and improved odds for a rate cut later this year inspired the risk-on trade. The question is how solid are each of those legs of the stool? It’s a topical question because weakness on any one of those fronts could knee-cap the two-week revival in confidence. Indeed, all three are interrelated and so if you pull the thread on one, the other two will deteriorate.

Markets will be keenly focused on incoming economic data to refine, refresh and perhaps reject the recent revival in risk-on sentiment. The week ahead, however, will be weak tea for US data.

The main events: weekly jobless claims on Thursday (May 9) and the first look at consumer sentiment data for May on Friday (May 10). Economists expect more of the same and so it doesn’t appear that we’ll learn anything new this week.

In turn, I’m expecting markets overall to trade in a range. The real fun awaits for the following week, when US consumer inflation numbers for April are published (May 15). Meanwhile, there are slim pickings for adjusting expectations based on macro news.

But don’t get too comfortable — geopolitical risk is still lurking, even if markets are inclined to downplay the various threats that continue to rage.