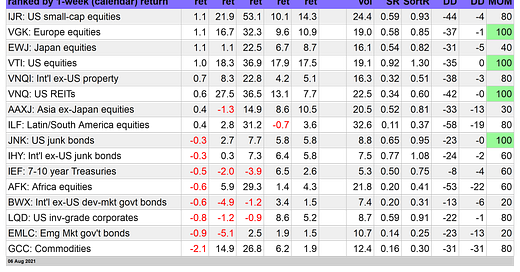

US small cap stocks continue to rebound

Bonds take a hit as US payrolls show surprising strength

Most of our portfolio strategy benchmarks posted gains this week

Is the small cap rally back on track? Too soon to say, but the trend continues to look encouraging, at least relative to the downside bias in the month through mid-July.

The iShares Core S&P Small-Cap ETF (IJR) rose for a third straight week through today’s close (Friday, Aug. 6), posting a solid 1.1% gain. The increase topped our 16-fund opportunity set for a second week.

IJR’s looking up these days, but it’s open for debate if there’s more to the rally than recovering a portion of the previous losses. A key test awaits in the weeks ahead: Will IJR take out its previous high? That would go a long way in helping dispel lingering doubts of the formerly high-rising fund. Meanwhile, there’s room for debate until there’s more clarity about the potential blowback in the US and beyond from the Delta variant of Covid-19.

Pandemic risk may still be lurking, but most stock markets posted gains this week, including the broad-based Vanguard Total US Stock Market Fund (VTI), which added 1.0% for the week. The ETF edged up to another record close, supported by today’s news that US payrolls rose more than expected. The U.S. Labor Department reported that the economy minted the most jobs in any month for the past year. VTI was quick to celebrate, topping off a near-perfect run of upside trending behavior in recent history.

Although economists have been worried that the Delta variant of coronavirus is taking a toll on the economic recovery, there was minimal evidence of damage in today’s jobs data. In fact, the surprisingly strong gain has inspired fresh concern that demand for labor remains robust, which in turn may keep inflation elevated. That didn’t sit well with bonds, which tumbled sharply this week.

The iShares 7-10 Treasury Bond ETF (IEF) tumbled 0.5%. A strong labor market report didn’t help. Then again, after five straight weekly gains, the fund was due for a pullback. The question is whether the rise in Treasury yields this week (the 10-year rate jumped to 1.31%, a three-week high) is noise? Today’s jobs data suggests that the Federal Reserve may be forced to start raising rates earlier than expected, although that would require a continued run of hot economic data and, presumably, minimal fallout for the Delta variant.

If the economic outlook is looking up, it wasn’t obvious in commodities prices this week, which retreated for the first time in four weeks. The equal-weighted WisdomTree Continuous Commodity Index Fund (GCC) tumbled more than 2%. That’s a bit surprising after seeing a strong payrolls print. Then again, GCC is still trading in a relatively tight range and is holding on to most of the gains from the rally over the past year. Commodities bulls can argue that the fund is in neutral and awaiting/anticipating the next round of robust economic and inflation numbers.

Most portfolio benchmarks posted gains this week: The lone exception is the equal-weighted Global Beta 5 Equal Weight (G.B5.ew), which holds five ETFs that cover the globe for the major asset classes. For details on all the portfolio strategy benchmarks and metrics in the tables, see this summary.

Don’t count out G.B5.ew just yet, however. Although the strategy gave up 0.3% this week, it remains comfortably in the lead year to date and is near the top for one-year performances.

Although G.B5.ew is slightly off its high, the rest of our portfolio benchmarks ended the week at new peaks. Bullish trends, in other words, remain the dominant theme for global asset allocation, as shown by the maxed-out momentum readings via the MOM scores in the table below.

Although the future remains uncertain as the Delta variant rages, the strong upside trending behavior in our strategy benchmarks appear to be pricing in relatively high odds that the global economic rebound will continue. ■