The ETF Portfolio Strategist: 6 Nov 2020

Risk Assets Bounce Back: Sometimes a week makes all the difference. While the world was obsessed over the US election (Joe Biden appears headed for the White House based on the latest vote counts), global markets rebounded after last week’s across-the-board sell-off. Every component of our standard lineup of the major asset classes posted a gain.

The big winner: stocks in South America: iShares Latin America 40 ETF (ILF) surged more than 12% this week by the close of today’s trading (Nov. 6). The rally still leaves this corner of world markets with a steep year-to-date loss of nearly 30%, but for the moment there’s a welcome run of excitement for trading in the lower Western Hemisphere.

Is this the start of durable rally for ILF? Maybe, although your editor remains cautious on the outlook. One reason: ILF’s momentum profile remains middling. Our proprietary MOM score is current 50, midway between extreme bearishness (0) and maximum bullishness (100), as shown in the table below. (For details on all the risk metrics as well as the strategies and benchmarks, see this summary.)

Equities generally dispensed strong gains this week. US shares bounced 7.3% via Vanguard Total US Stock Market (VTI). The fund’s rally leaves it just slightly below a record high.

Note, too, that Africa stocks continue to shine. VanEck Vectors Africa Index (AFK) gained 8.0%, pushing the fund to its highest close since February. In contrast with ILF, bullish momentum is strong for equities in Africa, as the ETF’s MOM score of 80 reminds — up from the previous week’s moderately bullish 70.

US Treasuries posted the weakest gain for the major asset classes. The iShares 7-10 Year Treasury Bond (IEF) edged up 0.4%, the first weekly gain in the past three. Despite the increase, IEF is still suffering a moderately bearish momentum profile. The fund’s MOM score, at 40, is the softest for the ETF proxies tracking the major asset classes.

For the year so far, the performance ledger remains mixed, ranging from the top performer to date – Asia ex-Japan equities (AAXJ) with a 14.5% gain – to a nearly 30% stumble for shares in South America (ILF).

Portfolio Benchmarks Bounced Too: With everything on the upswing this week, it’s no surprise that our yardsticks for global portfolios delivered robust gains. The Global Beta 16 (G.B16) benchmark jumped 5.6%, reversing all of the previous week’s loss (and more). For the year to date, G.B16 is up a modest 3.9%.

A Fresh Tailwind For The Proprietary Strategies: The top-performer for our in-house strategies: Global Managed Volatility (G.B16.MVOL), which rallied 5.6% this week. With a top-rated 100 MOM ranking, the strategy appears poised for more gains in the near-term future. (Note: all three of the proprietary strategies below use the 16 funds in the G.B16 benchmark as an opportunity set; the only difference: the risk-management strategy.)

Global Managed Drawdown (G.B16.MDD) squeezed out a small gain, but the strategy is getting whipsawed. In contrast with G.B16.MVOL, which continues to maintain a full risk-on profile, G.B16.MDD shifted to a nearly complete risk-off at the end of last week’s selling wave. But this week’s rally has reversed the shift and the strategy is again holding all but one of the 16 ETFs in its opportunity set. The outlier: iShares 7-10 Year Treasury Bond (IEF), which is still a risk-off ticker for G.B16.MDD.

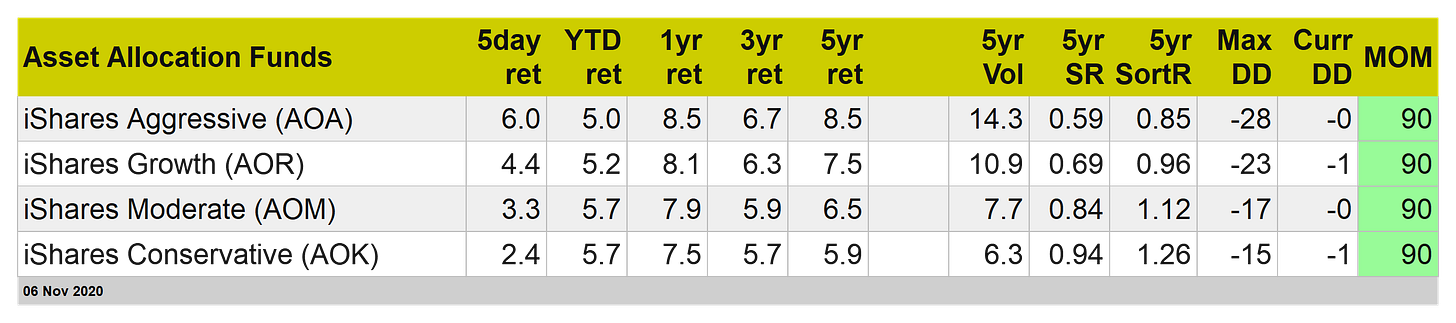

BlackRock’s ETF-based quartet of global asset allocation funds joined the party this week. The top-performer: iShares Aggressive (AOA). After falling a hefty 4.4% last week, AOA rallied sharply, advancing 6.0%, which left the ETF just slightly below a record close.

What comes next? Political risk appears to be fading as an in-your-face factor. As we write, Joe Biden remains on top in the vote count for the remaining states that have yet to report results. But just as political uncertainty is receding, coronavirus risk is rising again as infections, fatalities and hospitalization in the US rebound. Europe is also suffering from a new wave of infections.

The return of “normal” conditions for the global economy and world markets, it seems, still appears to be a conditions that will arrive further on up the road. ■