The ETF Portfolio Strategist: 7 JUL 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

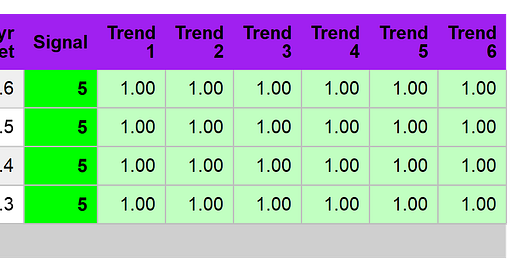

A set of asset allocation funds continue to reflect strong positive momentum through Friday’s close. Notably, all four ETFs are posting bullish Signal scores of 5, which is one notch below the highest possible reading. See this summary for details on the metrics in the tables below.

By some accounts, the market’s strength is a conundrum, reflecting high valuations at a time when various economic and geopolitical risks lurk. Fair enough, but the collective “wisdom” of the crowd begs to differ and continues to run prices higher. It’s reasonable to debate if this is a prudent of what lies ahead, but investors need to decide how much of a contrarian position they’re willing to adopt.

For some perspective, let’s start with a weekly price chart of the iShares Aggressive Asset Allocation ETF (AOA), which continues to set new record highs. Prudent or not, the crowd remains bullish and it’s not obvious that a sharp break to the downside is imminent.

For another perspective, consider the ratio of aggressive allocation (AOA) vs. conservative allocation (AOK). By this measure, a risk-on bias persists and, for now, looks set to persist.

One approach to managing risk is waiting for market signals to issue warnings and reacting to the new information. By that standard, it’s premature to shift to a risk-off posture.

Contrarians will push back on that view and note that the time to take money off the table is at or near record high. All the more so from the vantage of US stocks, which by some measures look overvalued. The danger here is that calling tops when market momentum is still strong requires a fair amount of hubris in assuming that we’re smarter than the market — a dubious assumption, to say the least, especially with regards to timing. Recall the old adage: the market can remain irrational for longer than you can stay liquid.

Then again, for conservative investors who can’t tolerate short-term risk — and are willing to forgo what could be substantial returns in the near term — the case for pulling back has merit. But if your risk tolerance is more or less average, or above average, and your time horizon is several years or longer, the technical profile for risk assets still look sufficiently bullish to stay the course. That is, until market momentum stumbles and the outlook turns net negative.

Drilling down into the major slices of global markets indicates a clear bullish bias as well. The table below suggests that continuing to hold a globally diversified portfolio looks poised to remain rewarding for the near term.

The standard caveat: the rosy analysis above could evaporate quickly in the days and weeks ahead. Then again, a sudden change in market sentiment is always possible. But if we start our analysis on the basis of what markets are telling us right now, the message is unambiguously bullish. Yes, that will change at some point, but the timing is unclear as always.

The good news for medium- and long-term-horizon investors, market signals will almost certainly dispense clear warnings that the sentiment tide is shifting. That turning point, for now, remains in the future.

To be fair, rebalancing a multi-asset-class portfolio looks timely, but making dramatic changes beyond a normal reshuffling of risk allocations falls into the category of rank speculation. Sometimes that can pay off, but taking a hard shift toward risk-off when market momentum is firmly bullish comes with its own set of risks — risks that aren’t usually rewarded over a full business cycle except for the small fraction of investors who are extremely talented, or lucky. ■