It may be the most unanticipated rally of the summer, but there’s no denying the strength and breadth of the bond market’s surge of late.

As Treasury yields continue to slide, the decline is lighting a fire for bond prices. It’s all quite a striking turnaround from earlier in the year, when there was a near-consensus that sharply higher inflation would trigger a bond-market selloff. And it did, in the first quarter. But in April the tide began to turn and it’s been turning ever since in favor of lower yields.

The benchmark 10-year Treasury rate continued to decline in today’s trading (July 7), falling to 1.33% -- the lowest since Feb. 18. As the weekly chart below shows, this week’s drop (so far) marks something we haven’t seen until now in the decline: a significant gap down in yield.

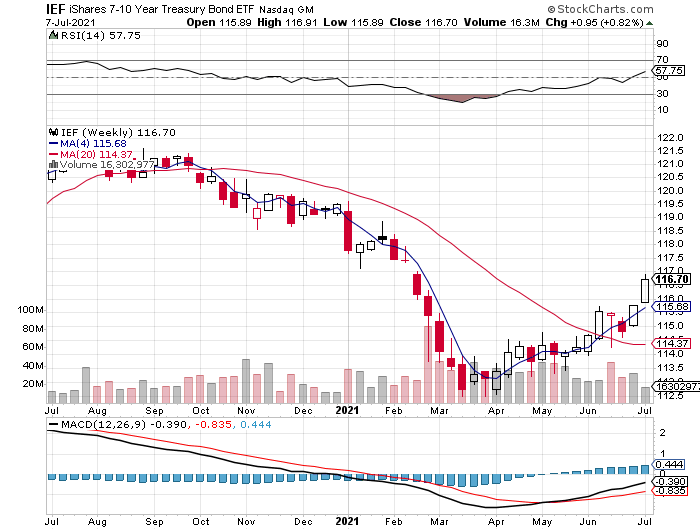

In turn, our Treasury proxy fund rallied for a third straight day. The iShares 7-10 Treasury Bond ETF (IEF) closed up again in Wednesday’s trading, lifting the fund’s price to the highest level in nearly five months.

Investment grade corporates are doing even better: iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) ended the session at the highest price since January.

What’s driving yields down and bond prices up? There are many theories making the rounds, including forecasts in some corners that the economic rebound is due to slow — faster and deeper than expected as the effects of government stimulus fade.

The counterargument: the economic rebound remains robust and recession risk remains low for the foreseeable future. That starts with the upcoming preliminary estimate of the government’s second-quarter GDP report (due for release on July 29), which is expected to post a substantial acceleration in growth over Q1’s pace. The Atlanta Fed’s GDPNow estimate for Q2 (as of July 2), for instance, sees output rising 7.8% — a sizable improvement over Q1’s 6.4% increase.

So far, so good, although the Q2 nowcasts generally have been sliding. Is that a sign that a substantial slowdown in growth is brewing for the second half of the year? The bond market seems increasingly inclined to price in higher odds of that scenario.

Even if the next recession is far off, it’s likely that growth has peaked or is peaking. Meanwhile, the Federal Reserve is still pushing its transitory narrative for the recent runup in inflation, along with recent hints that if inflation appeared more persistent than expected the central bank wouldn’t hesitate to tighten policy.

There’s a school of thought that argues that the US economy can’t withstand higher interest rates, even if the catalyst is worthy a la nipping inflation in the bud. As a result, even a whiff of tighter policy is a potent catalyst to unleash a new round of bond buying.

An alternative narrative, and one that (still) remains plausible: the Treasury market has pulled back on the reflation trade in an effort to hedge its bets and is awaiting further data.

The 10-year yield is still above the midpoint of the rally off the lows of last August and so it’s premature to assume that the jig is up for the reflation trade. What you can say is that the bond market is becoming a bit more skeptical that inflation and economic growth have reached a permanently higher plateau. ■