The ETF Portfolio Strategist: 7 May 2023

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Markets continue to flirt with an upside breakout of the recent trading range, but the appetite for going higher still looks low as a number of risk factors continue to prowl. The appetite for selling, however, is also restrained. Investors seem to be waiting for clearer signs of what’s ahead. Meantime, the churn persists.

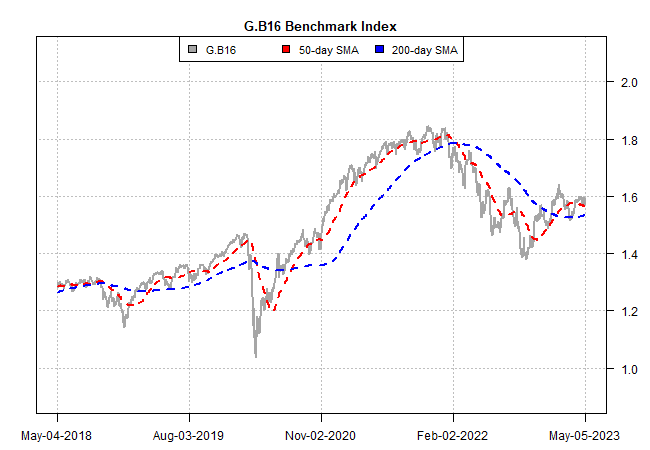

Our 16-fund global benchmark (G.B16) slipped fractionally last week, as did all our strategy benchmarks. G.B16 is still struggling to break out of its box, and that’s not likely to change until deeper clarity/progress arrives on several fronts, including: resolution of the ongoing debt-ceiling impasse in Washington and greater confidence that inflation’s recent downshift isn’t materially slowing or (worse) remaining stuck a still-elevated levels. Progress on those front would go a long way toward strengthening the Federal Reserve’s resolve to pause its rate hikes. See this summary for design details on the strategy benchmarks and this summary for how the metrics in the tables below are calculated.

One of the reasons to stay defensive is the inconsistency of the upside momentum signals lately. For several funds in the G.B16 opportunity set, the arrival of strong bullish Signal scores recently has been short-lived, which suggests the market’s conviction on further gains is weak.

Even for one of the more consistent upside readings — stocks in Europe (VGK) — the chart action for the ETF suggests reserving judgment. Until/if VGK can convincingly, persistently poke above its late-2021 highs, this market appears set to trade in a range, albeit in the upper range of recent history. My spin: VGK has priced in a sigh of relief that the worst of the Ukraine-war-related blowback has been avoided so far. Deciding what comes next, however, is till open for debate as the war transitions to stalemate and the risk outlook shifts from the acute to the chronic. Discounting this possibility/likelihood is challenging, which suggests that VGK will have trouble moving much higher until the geopolitical/geoeconomic risk landscape looks less troubling.

It’s a similar story for US stocks (VTI), albeit with less upside bias. American shares continue to bump up against recent highs, which suggest the market’s waiting to see how the risk factors noted above evolve in the weeks ahead.

Ditto for US Treasuries (IEF), which continue to trade in a range. The market’s kicking the tires on the idea that the Fed will pause rate hikes, but much depends (still) on how the incoming inflation data fares, starting with this week’s consumer price data for April (Wed., May 10). The consensus forecast sees inflation basically holding steady at still-elevated levels—hardly the news that will deliver an “all clear” signal.

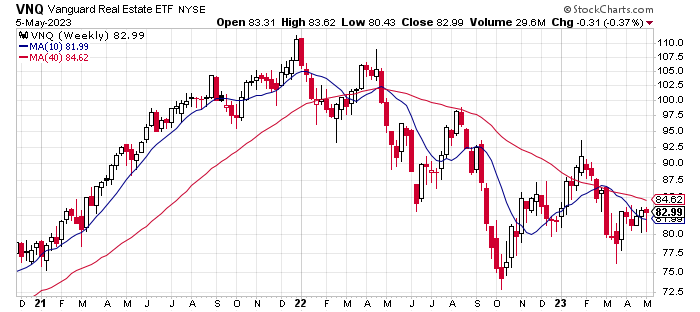

Some trends are clearer and stronger. US real estate investment trusts via VNQ, for example, still look caught in ongoing bear market, albeit one currently in remission.

Meanwhile, commodities look set to re-test downside support after a long run of treading water.

There are more shoes to drop. The challenge is deciding when and which ones. That’s a high bar, and so I continue to favor staying defensive. ■