Correction: An earlier version of this edition incorrectly noted that iShares iBoxx $ Investment Grade Corporate Bonds (LQD) was the only ETF on our proxy list for the major asset classes with a bearish MOM score. That was incorrect. I should have reported that iShares 7-10 Year Treasury Bond ETF (IEF) is the only ETF with a deeply bearish MOM score on the list of fund proxies for the major asset classes. The text (and the chart) has been corrected below. Apologies for the confusion.

In this issue:

The stock market shrugs off Capitol chaos

A bullish start for strategy benchmarks in the new year

Diverging paths for managed risk strategies

Is Insurrection Bullish? Let’s just say that judging by the week just ended, the stock market isn’t easily shaken by such distractions as riots in the US Capitol or political turmoil in Washington.

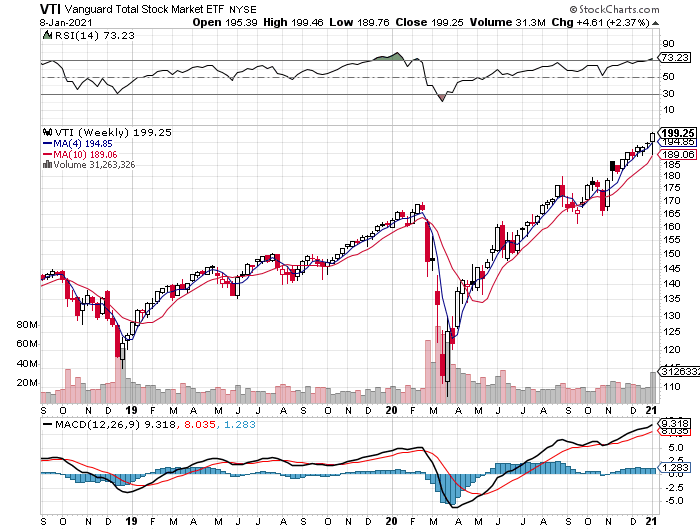

Whatever you think of the events in Washington this past Wednesday, Jan. 6, the US equities market barely noticed. A broad measure of shares posted a strong gain for the trading week through today’s close (Friday, Jan. 8). Indeed, Vanguard Total US Stock Market (VTI) advanced 2.4%, the fourth straight weekly advance and the biggest since early November.

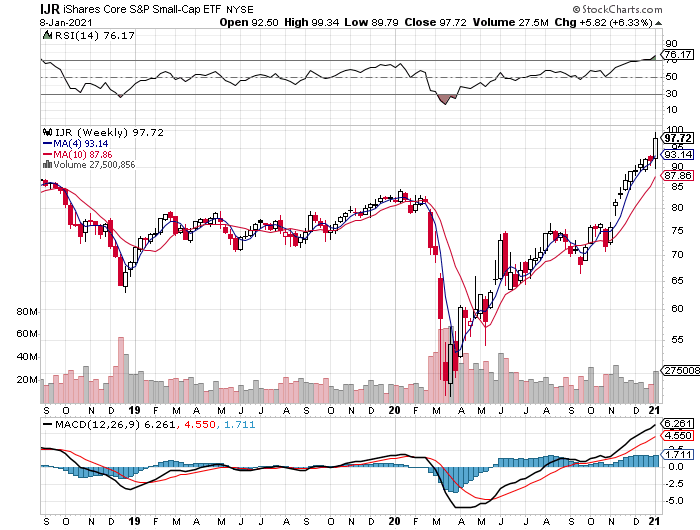

In fact, VTI’s performance was middling this week relative to a broad set of ETFs that serve as proxies for the major asset classes. The top-performer this week: US small-cap stocks. The iShares Core S&P Small-Cap Stocks ETF (IJR) surged 6.3%. The fund pulled back in today’s session, but that still left IJR only slightly below a record close.

Although most slices of the global markets ended higher this week, several flavors of bonds took it on the chin. The deepest loss, however, was in US real estate investment trusts (REITs): Vanguard US Real Estate (VNQ) fell 2.2% this week.

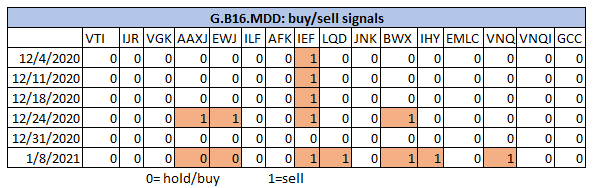

Meanwhile, momentum remains bullish in nearly every nook and cranny of the major asset classes, based on our proprietary MOM indicator. It’s debatable if this is irrational exuberance or a clear-eyed view of future prospects. Whatever you call it, there’s an ample supply. The only fund suffering from a heavily bearish MOM score in the table above: US Treasuries via iShares 7-10 Year Treasury Bond ETF (IEF). (For details on all the risk metrics as well as the strategies and benchmarks, see this summary.)

Bullish Start For Strategy Benchmarks In 2021: There was no sign of anxiety in broadly defined portfolio strategy benchmarks this week. Leading the charge higher in the kickoff to the year: our Global Beta 16 benchmark (G.B16), which holds a global opportunity set of the major asset classes in a 60/30/10 mix of equities, bonds and alternatives (commodities and REITs).

G.B16 rose 2.1% this week, thanks to surging foreign equities. The gain was more than twice the 1.0% increase for the US 60/40 stock/bond (US.60.40). G.B16’s latest pop has narrowed the 1-year-return gap with US.60.40 to 1.6 percentage points.

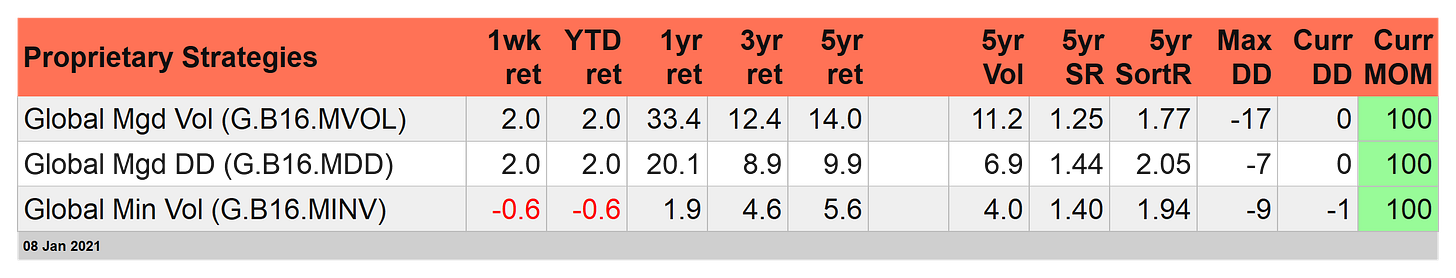

Managed Risk Strategies Go To Extremes: Two of our proprietary risk-managed strategies soared in the first week of 2021 trading. By contrast, the minimum volatility portfolio suffered a black eye.

First the good news: Global Managed Volatility (G.B16.MVOL) and Global Managed Drawdown (G.B16.MDD) jumped 2.0% this week. But that’s where the similarities end for these two portfolios. While G.B16.MVOL remains in a risk-on posture for all its funds, G.B16.MDD switched to risk-off positions as of today’s close for 5 funds (see table below). Note that both strategies use the G.B16 set of funds listed above—the only difference is the risk management strategy.

Meantime, Global Minimum Volatility (G.B16.MINV), which also targets G.B16 funds, took a hit this week with a 0.6% slide. The strategy’s reliance on fixed income to smooth return variance has backfired lately, a failure that’s been especially conspicuous in recent days.

Finally, note that the aggressive version of BlackRock’s asset allocation ETF topped all the strategies listed above for this week’s results. The ishares Aggressive (AOA) roared up 2.3% in the opening run for 2021.

It’s too early to know if taking on more risk will pay off again in 2021, but it’s not too early to dream. There’s a limit to everything, of course, but favoring risk is still enjoying a strong edge over its cautious counterpart. There’s no telling how long this preference will hit pay dirt, but for the moment there’s no sign that battening down the asset allocation hatches is about to outperform what’s known in professional circles as ‘let ‘er rip.’ ■

Mr. Picerno:

I am avid fan of your Capital Spectator site, appreciating its sage advice and clear prose.

A couple questions about the G.B16 portfolio and the active strategies.

1) The G.B16 portfolio lacks a small cap ex-US ETF, say, for example, VSS. Is there a logic for its absence?

2) The stellar performance of the G.B16.MVOL for 2020 (up 30%) certainly makes it a seemingly appealing strategy. But is it your sense this is maybe a bit of an one-off performance? One maybe attributed to high volatility during March’s descent followed by a relatively low volatility during the subsequent climb back up?

3) You’ve observed previously that normally the G.B16.MVOL has at least one asset in the risk-off category. Yet I don’t see any sell signals after March. In fact, looking at VTI as an example, I don’t see any sell triggers starting 2016 and prior to March 2020. (This assumes I have correctly incorporated the filters for the triggers into the data analysis.) Does this make sense?

Thanks, Dan M.