The ETF Portfolio Strategist: 8 JUNE 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Was it all noise? Yes, or so markets are telling us.

The trade-induced turmoil that took a bite out of risk assets has more or less completed a full U-turn. The potential for trouble is still lurking, of course. What’s changed is that the market has a higher tolerance for turbulence and uncertainty. The crowd, in other words, has learned to manage expectations for a new world order of tumult and confusion with respect to the formerly sedate realm of trade policy.

No one knows how the recent tariff upheaval will evolve, except to say that the only certainty is uncertainty and surprise. That was a problem in April, but it’s just another risk factor today, albeit a slippery and potentially potent one that hasn’t lost its ability to surprise. Markets will reprice the outlook accordingly, depending on how the news flow evolves. What markets have ceased to do is reprice based on the shock factor triggered by policy change regime shift. That was then; this is now.

Progress, you might say, but let’s not forget that while the market has developed a level of comfort with the recent evolution in the global trade paradigm, sentiment remains vulnerable to further shocks, as always. Presumably any future shocks (and you know they’re coming) will have to be relatively dramatic to move the sentiment needle at this late date.

On a positive note, it’s reasonable to wonder if the worst of the shock and awe repricing is behind us and we’ve transitioned to a relatively “normal” phase in which future volatility events will be less chaotic and more logical in the sense of reactions that seem appropriate for the events du jour.

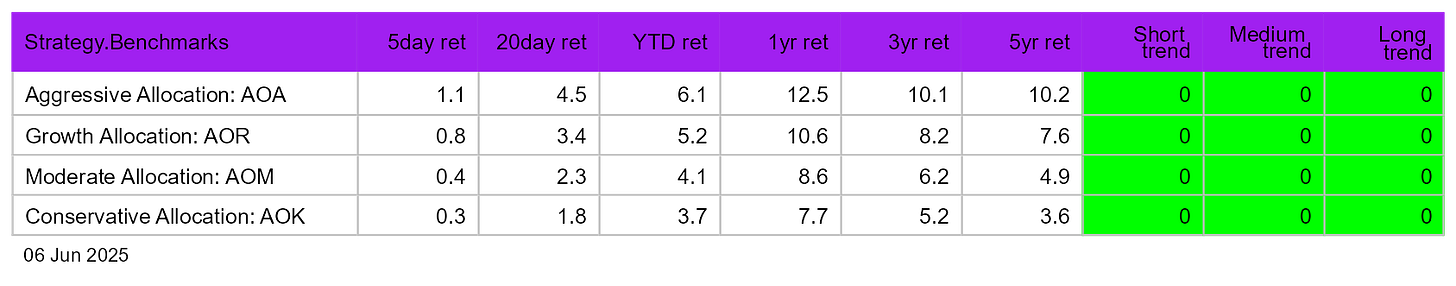

For the moment, markets appear comfortable with current paradigm, even though the future is no less certain today than it was in April. All of our usual set of global asset allocation proxies rose last week and favor risk-on for the short-, medium- and long-term trends. Although it’s been a roller coaster for the short- and medium time horizons, which briefly shifted to risk-off and then reversed course recently, the long-term signal never wavered and remained risk-on throughout.

Most of the primary slices of global markets have also returned to strong risk-on readings.

The recovery for stocks in Africa (AFK) has been especially pronounced. Year to date, AFK is the performance leader for the chart above, surging 28.1% so far in 2025.

European shares are also hot. The Vanguard FTSE Europe ETF (VGK) has rallied 23% this year and ended the week at a record high.

US Treasuries, by contrast, are struggling, and it’s worth watching how these bonds fare since the results could (and probably will) have implications for stocks generally. The iShares 7-10 Year Treasury Bond ETF (IEF) continues to trade in a range. The issue is that the Federal Reserve remains in a wait-and-see mode for monetary policy, weighing the odds of higher inflation vs. slower economic growth, or possibly both.

The central bank is expected to stand pat at next week’s policy meeting, according to Fed funds futures. St. Louis Federal Reserve President Alberto Musalem on Friday said the odds of an extended rise in inflation due to the trade war are 50-50, and that the uncertainty would last through the summer.

Adding to the uncertainty for monetary policy is the budget bill now under scrutiny in the Senate. The “one big beautiful bill” is expected to deepen an already hefty federal budget deficit. The question is whether the Senate will materially change the bill to soothe budget hawks?

Signaling from the US 10-year Treasury yield aligns with Musalem’s 50-50 outlook for what’s coming as the benchmark rate continue to trade in a range.

The 10-year yield ended the week at 4.51%, a middling level vis-a-vis the year to date. I expect this key rate will soon break out of its range, thereby triggering a significant attitude adjustment for markets generally. The mystery is whether the breakout is up or down, which will be influenced in no trivial degree by the details that emerge from the Senate’s input to the legislation.

The bottom line: the bond market will be keenly focused on whether inflation or slowing growth becomes the dominant risk factor. The worst-case scenario: both risk factors will resonate.

All of which brings us back to the trade war. How policy unfolds on this front will play an outsized role, one way or another, in the second half of the year for inflation and growth. Markets seem to be comfortable with this uncertainty at the moment, but it’s a precarious balancing act. On the other hand, it beats a kick in the head. ■