Back by popular demand: Several readers requested that I continue to update the so-called proprietary strategies and so I’m reversing the recent decision to pull the plug on these portfolios. For those who are interested, I’ll update the results weekly.

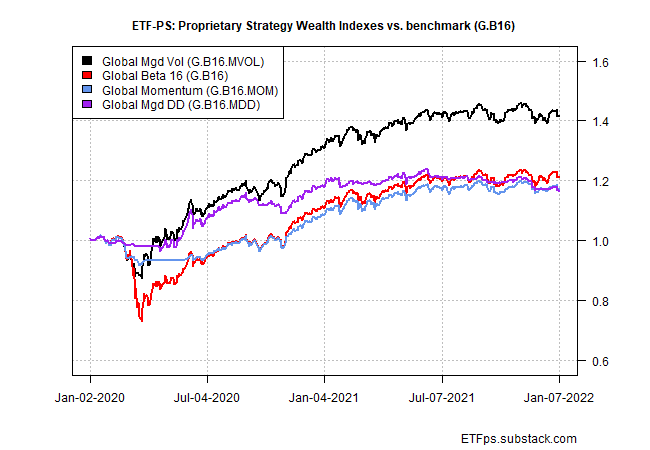

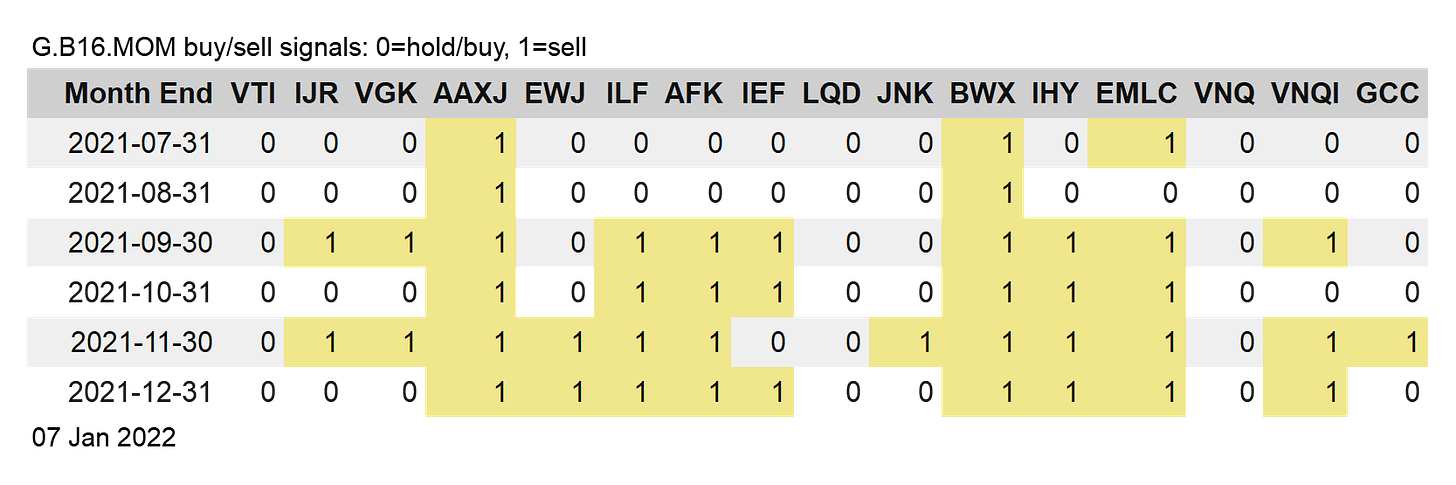

I’m rebranding the trio as as Active Risk-Management Strategy Benchmarks, which is to say that they’re useful for developing perspective on how risk is evolving in recent history vis-a-vis our standard 16-fund opportunity set. For details on how these strategies are managed, see this summary.

Following these strategies to the letter for real-world money management is probably going a bit too far, particularly for taxable accounts. Indeed, there’s a lot of short-term turnover in these portfolios. But there’s no cost for looking. With that in mind, here are the latest numbers (through Friday, Jan. 7):

Dear Jim, many thanks for that. I'm curious how these will get through a year that may have some more risk to manage than the last one. Cheers.