The ETF Portfolio Strategist: 06 JULY 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

The gravy train rolls on. The holiday-shortened trading week in the US dispatched another across-the-board win for globally diversified portfolios. All the usual suspects for risk continue to lurk, but market sentiment continues to minimize the various threats and uncertainities hiding in plain sight.

Our four ETF proxies for globally diversified strategies again enjoyed solid gains last week, led by the aggressive portfolio (AOA), which rose 1.2%. Year to date, AOA is up 10.0%. Its counterparts are also posting robust increases. The implication is that the calendar year results are on track to post strong performances that exceed the wins in each of the past two calendar years. To repurpose Benjamin Franklin’s famous quote about the prospects for America’s political system, It’s a triple multi-year win in the making… if you can keep it.

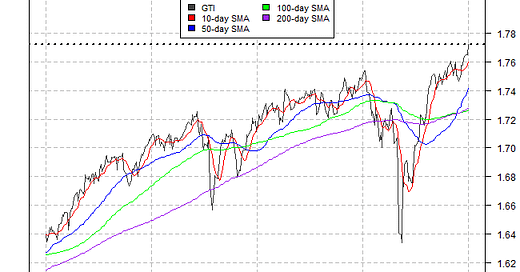

For the moment, market momentum shows no sign of sheddding its winning bias. Our Global Trend Indicator (GTI), which aggregates the technical profiles of the four ETFs above, reached yet another new high on Thursday (July 3). The rise reaffirms the strong bullish profile for market momentum overall.

The recent rebound in markets following the tariff tantrum in April offers a fresh dose of support for long-term-oriented investors with the wherewithal to remain immune to every twist and turn in market action. Although our short- and medium-term trend indicators for the asset allocation ETFs above switched to risk-off early on in the spring selling (and have subsequently flipped back to risk-on), the long-term trend indicator never wavered and stayed risk-on (see, for example, the chart for AOM below).

All is clear in hindsight, of course. Deciding if the current environment will remain conducive to risk-on isn’t getting any easier these days. For those of us who are anxious, however, it’s useful to note that risk-on is still the dominant theme for all the major slices of world markets, as the table below reminds.

The main takeaway: Adopting defensive positions in more than trivial degrees looks premature at the moment. Hard-core contrarians may think differently. Current conditions from a trend perspective are priced for perfection, which implies that mean-reversion risk may yet be set to spike. If you’re a short-term trader with a high tolerance for volatility, that’s a reasonable view, but for most investors it’s too early to start pulling the plug on risk exposure beyond modest changes.

Don’t misunderstand: Your editor is keenly aware that record highs in several key markets and strategy benchmarks combined with a number of hefty macro risk factors threatening for the near-term horizon is becoming uncomfortable from a behavioral perspective. Markets, however, could care less if you’re losing sleep because you’re worried about your nest egg’s prospects over the next several months.

None of this changes the fact that the issues we’ve raised recently persuade us to sleep with one eye open. At the risk of repeating some of last week’s commentary, two potentially consequential topics are top of mind for the immediate future: tariffs and the newly minted mega spending bill that’s expected to lift the US federal budget deficit by $4 trillion-plus over the next decade (according to the Penn Wharton Budget Model).

Deciding when or if markets will price in these risk factors is in the realm of rank speculation and so we’re proceeding with extreme caution here. But ignoring these risk factors won’t make them go away.

On that note, the temporary pause on tariffs that President Trump announced in April are set to be reinstated this week (July 9) short of new deals that passes the smell test for the White House. A key facet of those potentially reviving tariffs that will be in sharp focus in the days ahead relates to the European Union and how or if the trade dispute will be resolved in some degree over the next several days. But in a recent twist, July 9 is now considered the date for the end of the grace period and August 1 is when the administration could announce new tariffs on countries (as high as 70%) for countries that don’t reach a deal with the US.

"It's not a new deadline [Aug 1]. We are saying, this is when it's happening, if you want to speed things up, have at it, if you want to go back to the old rate, that's your choice," Treasury Secretary Scott Bessent said today.

What remains clear is that the economic stakes are still high for growth and inflation, even if the exact drop-dead dates are in flux. The timing and degree of tariffs (or the lack thereof) carries significant implications for the macro outlook, including inflation, which in turn will drive decisions for monetary policy, Treasury yields, and more.

Meanwhile, the question of whether markets (the bond market in particular) will be pricing in higher fiscal risk due to expectations for a deeper US budget deficit in the years ahead is front and center. The 10-year US Treasury yield rose for three straight days ahead of the July 4 holiday and is currently at 4.35%, a middling range vs. recent history. Are we set to go higher still now that the mega spending bill is law?

Although I can conjure any number of worrisome scenarios that could play out, my real-world strategy is to sit tight, monitor markets and economic data, and stay focused like a laser beam on early signs of change in sentiment via our trend indicators.

On that last point, the all-clear remains in effect. The main caveat, of course, is that the validity for this signaling requires a fresh recalculation every day. It’s the worst possible way to manage a globally diversified portfolio for a medium-to-long-term horizon… except when compared with the standard alternatives. ■

Thank you for your thoughtful article. I like the previous commenters suggestion of stop loss orders, but am less certain about t-bills or bonds as an option. The Dollar$ is already down 10% YTD and if the folks in DC resume punitive tariffs, the Dollar will likely fall much further. I have increased my cash and non-US holdings, but per your comments, have mostly nibbled at this sort of diversification. I am hopeful that some level of sanity will be achieved by policy makers, but also know that "hope" seldom leads to successful investment outcomes. The phrases "new paradigm" and "this time is different" often prove wildly inaccurate, but as we all know, fat tail risk is not zero.

I am keeping tight stop loss orders on all my positions until things break, then hopefully I will have the stomach to buy during the time when all commentary is saying market is going to zero, put all your money in t-bills.

Thank you for your detailed informative post, I really appreciate it.