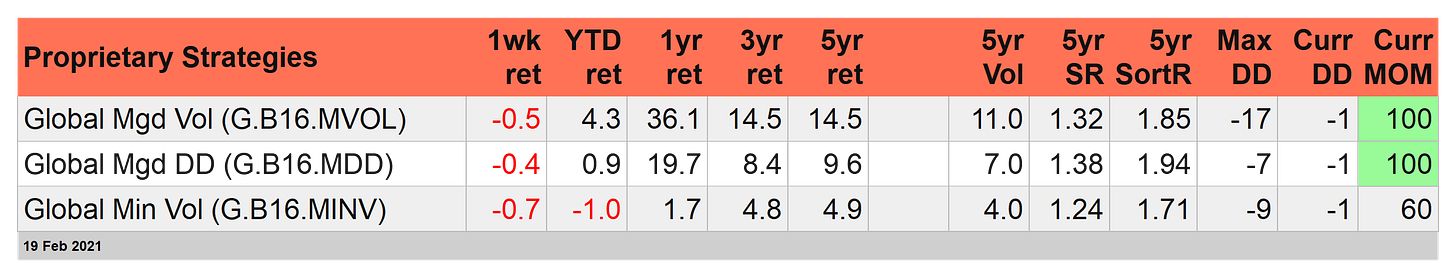

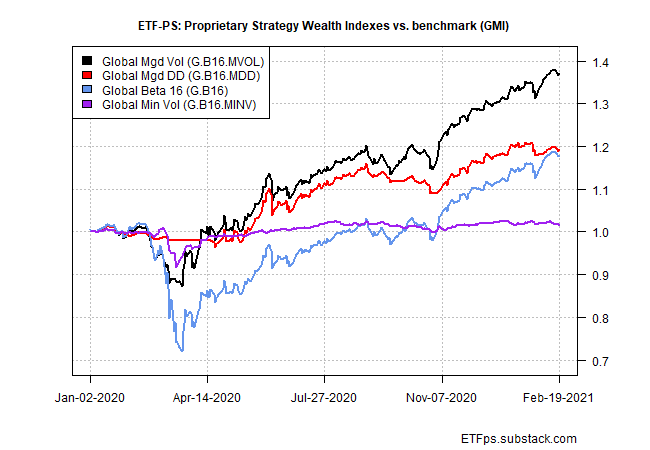

There was nowhere to hide in last week’s broad-based market decline for our proprietary strategies: all three took it on the chin. The declines for the trading week through Feb. 19 were in line with the benchmark, Global Beta 16 (G.B16). Year to date results, however, are another matter.

Global Managed Volatility (G.B16.MVOL) is the best performer among our trio of homegrown strategies. But G.B16.MVOL’s 4.3% gain so far in 2021 falls slightly short of its G.B16 benchmark, which targets the same opportunity set of ETFs on a buy-and-hold/year-rebalancing basis. The other two proprietary strategies, by contrast, are well behind G.B16 so far this year. Perhaps this is a sign that beating beta is going to get tougher in 2021. For details on strategy rules and risk metrics in this article, see this summary.

Despite last week’s widespread declines across most slices of global markets, G.B16.MVOL remains unconvinced that we’re at the start of an extended decline (or bear market). The strategy remains risk-on for all its fund holdings through Friday’s close:

Global Managed Drawdown (G.B16.MDD) begs to differ. The strategy has become increasingly defensive and is now risk-off in 11 of its 16-fund opportunity set. Note: all three proprietary strategies and the G.B16 benchmark target the same 16 funds, as shown in the table at the end of this article.

Either G.B16.MVOL or G.B16.MDD is headed for an attitude adjustment. When and if both strategies are issuing similar broad-minded risk-on or risk-off signals, the future will arguably be a bit less cloudy. By that standard, there’s still plenty of room for debate about what comes next. ■