The ETF Portfolio Strategist: 25 AUG 2024

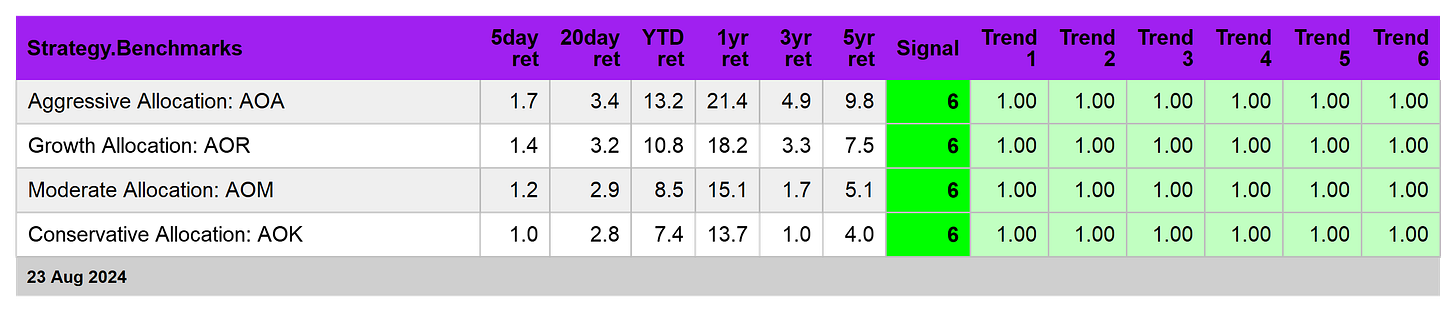

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

The next update of The ETF Portfolio Strategist: Sep. 8

The winning streak in global markets continued for a third week through Friday’s close (Aug. 23). The rally has now recovered all of the late-July/early August sell-off and pushed prices above the previous highs, based on our standard set of global asset allocation ETFs. As an added bonus, momentum strength remains red hot, based on our proprietary Signal score. See this summary for details on the metrics in the tables.

Your editor has been anxious in recent weeks, thanks to the volatility spike in markets that, for a time, took a toll on sentiment and returns. But once again the behavioral risk that routinely afflicts human wetware was minimized as yours truly was guided away from an extreme and ill-timed emotional response to what has been, so far, another short-term event with virtually nil relevance for time horizons that stretch beyond the immediate future.

One of the metrics that’s promoted staying calm: the Global Trend Indicator (GTI), which calculates relative trend behavior in the aggregate for the four asset allocation ETFs listed in the table above. As I discussed on Aug. 4: “I’ll be watching in the days ahead to see if the [GTI’s] 50-day average (blue) drops below the 100-day average (green).” To date, that tipping point hasn’t arrived, which is one reason why I’ve been able to remain relatively serene compared with what the darker angels of my behavioral-driven investing nature would prefer.

Focusing on an aggressive global asset allocation fund (AOA) drives home the fact that the recent correction was both short and mild, as these things go. Then again, it felt otherwise when we were in the middle of it. But per the GTI summary above, it always looked like noise from a quantitative perspective, even if it felt more painful in real time.

Metrics like GTI aren’t foolproof, but they do provide a hefty dose of perspective when it’s needed most: as an antidote to the headlines du jour in periods of market extremes. If and when GTI and its many variations signal higher odds that trouble is brewing, the case for turning defense will be conspicuous. That could be a false signal, of course, but if we’re playing the game of calculated risks, the price of entry is recognizing that signaling accuracy always and forever falls well short of 100%. On the other hand, the success rate (for a well crafted signaling model) is almost surely well above the results you’ll earn from an ad-hoc qualitative process.

Meantime, it’s encouraging to see that the strong upside bias shown in the top-level view via the asset allocation funds echoes loud and clear via a more granular view of markets, per the table below. Nearly every slice of the global markets is posting bullish Signal scores. The lone exception: Latin America stock (ILF) with a modest net positive reading.

Despite the strong trending behavior, this is no time for complacency. A possible shift in the economic regime to slower growth is one reason. Another is elevated geopolitical risk. Markets have effectively shrugged off a number of conflicts around the world — conflicts that, in theory, pose severe threats to the global economy. Priced in or not, the threats continue to burn in the Middle East, Ukraine-Russia, and beyond. Today’s news of Israel’s strikes on southern Lebanon is a reminder that the potential for a spiraling conflict with unintended consequences and global reverberations is a constant presence.

To date the risk have been dismissed by markets writ large. Minds will differ on when, if ever, the crowd will demand a higher risk premium due to these factors. Meantime, dismissing/overlooking the dangerous state of global affairs is imprudent.

Deciding what, if anything, to do about it vis-a-vis portfolio allocations is a tricky issue. For conservative strategies and low-risk-tolerance investors, however, the case for taking advantage of high prices and adopting some degree of defensive posturing has appeal. We’ve been making a similar point for months — advice that, so far, has been a net negative based on opportunity costs. So it goes in the realm of calculated risks based on assessing uncertain futures.

Meanwhile, global markets are again flashing the all-clear signal. How long will that last is anyone’s guess, but at least we have some objective metrics for reference the next time markets swoon and the wetware panics. ■