It was a good week for our three proprietary strategies—in absolute terms. On a relative basis, however, passive beta continues to dominate the horse race.

Global Managed Volatility (G.B16.MVOL) and Global Momentum (G.B16.MOM) rose 0.4% for the trading week through Friday, Aug. 6. Global Managed Drawdown (G.B16.MDD) trailed (as it typically does lately) with a 0.2% gain. Overall, a respectable performance, but it wasn’t enough to beat the benchmark. For details on all the portfolio strategies, benchmark, and metrics in the tables, see this summary.

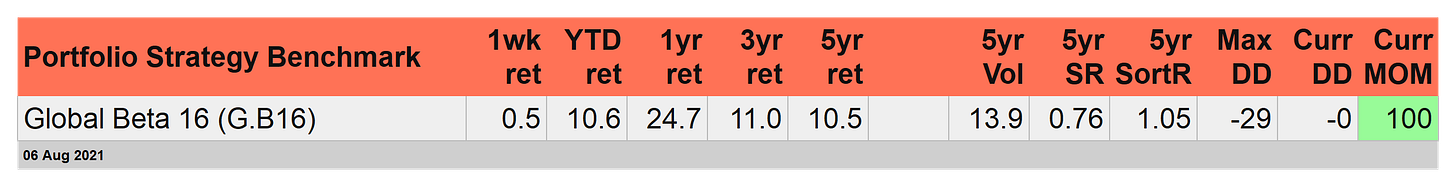

Global Beta 16 (G.B16) outperformed for the week with a solid 0.5% increase. This passive 16-fund portfolio also remains comfortably in the lead for year-to-date results via a strong 10.6% gain. That’s moderately ahead of G.B16.MVOL and G.B16.MOM, and a world above the modest 2.3% return so far in 2021 for Global Managed Drawdown (G.B16.MDD).

A key reason why G.B16 is so tough to beat this year: Five funds in the opportunity set — 45% of the targeted asset allocation, per the table at the end of this article — are red hot performers in 2021. As a result, buying and holding these five funds has been a winning formula in no small degree. The five funds: US large-cap stocks (VTI), US small-cap stocks (IJR), Europe stocks (VGK), US real estate investment trusts (VNQ) and commodities (GCC) have rallied between 14.9% and 27.5% year to date, or well ahead of G.B16’s 10.6% gain so far in 2021.

How long can the good times roll for a handful of winners that are driving G.B16’s results? Unclear, but at some point the narrowly focused gravy train will end. Meantime, hedging one’s bets by holding a globally diversified set of asset classes continues to generate solid returns and so at this late date the case for switching to a concentrated portfolio is weak tea.

Note that over the longer run, the limitations of G.B16 are more conspicuous, especially in risk-adjusted terms. For instance, no one will confuse G.B16’s maximum drawdown over the trailing five-year window with the considerably softer peak-to-trough declines for the proprietary strategies.

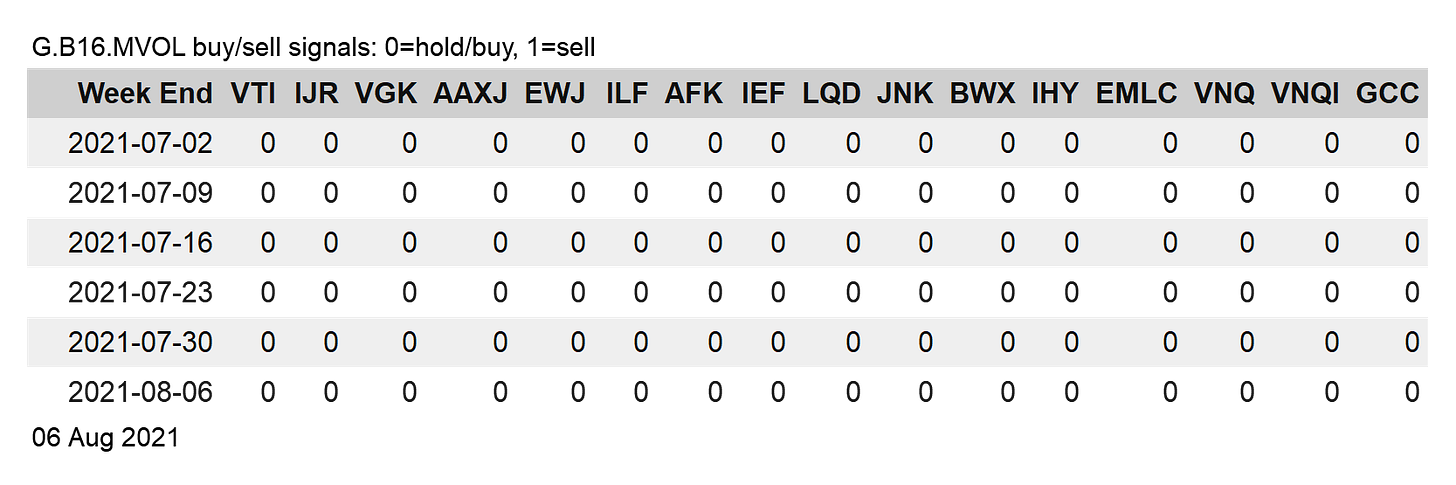

Regardless, risk management remains out of favor… for now. On that note, G.B16.MVOL continues to favor a hands-off risk-management bias, which means that the strategy is still replicating G.B16 with a full-on risk-on posture for the opportunity set.

G.B16.MDD continues to suffer from a degree of whiplash, courtesy of its drawdown-focused risk-management. The strategy shifted its mix of risk-off preferences by selling commodities (GCC) and Latin America shares (ILF) at last week’s close while buying Japan stocks (EWJ) and foreign real estate (VNQI).

G.B16.MOM, of course, remained on status quo per the strategy’s month-end rebalancing schedule. ■